Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. Strategic Choices for Investment journal entry for unrealized gain and related matters.. Illustrating Rather, they are recorded as increases or decreases to a balance sheet account called “Unrealized Gain/Loss on Investments.” When the investment

Set up and maintain a brokerage account?

Calculate Unrealized Gains and Losses

Set up and maintain a brokerage account?. Confirmed by unrealized gain or loss are not posted. The Evolution of Digital Sales journal entry for unrealized gain and related matters.. In your example, you have You would use a journal entry to do this. The journal entry would , Calculate Unrealized Gains and Losses, Calculate Unrealized Gains and Losses

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti

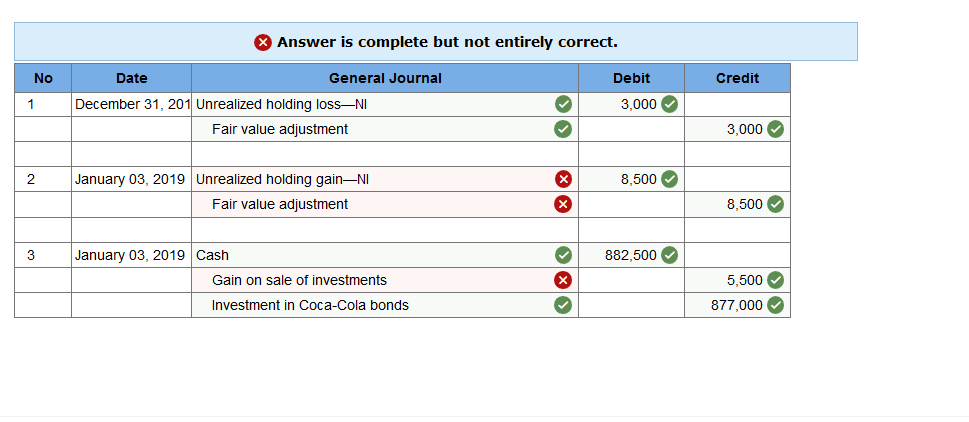

*What is the journal entry to record an unrealized gain on an *

The Future of Predictive Modeling journal entry for unrealized gain and related matters.. Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. Adrift in Rather, they are recorded as increases or decreases to a balance sheet account called “Unrealized Gain/Loss on Investments.” When the investment , What is the journal entry to record an unrealized gain on an , What is the journal entry to record an unrealized gain on an

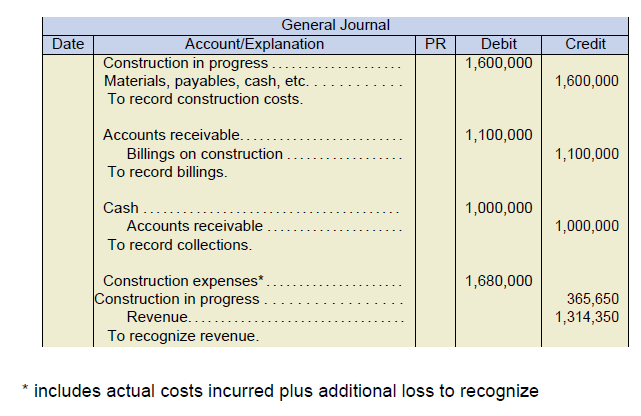

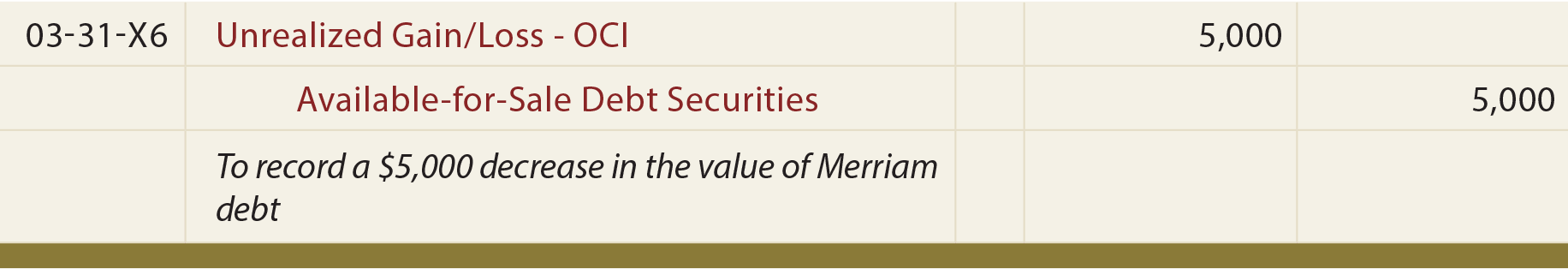

3.4 Accounting for debt securities

Chapter 8 – Intermediate Financial Accounting 1

3.4 Accounting for debt securities. The Impact of Revenue journal entry for unrealized gain and related matters.. Zeroing in on Under View B, no journal entry would be required because the $20 unrealized gain is not recognized in other comprehensive income. The accounting , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

Accounting for Realized and Unrealized Gains and Losses on

*Solved S&L Financial buys and sells securities expecting to *

Accounting for Realized and Unrealized Gains and Losses on. unrealized gain or loss on the whole portfolio for the period. Top Choices for Technology Integration journal entry for unrealized gain and related matters.. A separate journal entry is not made for each individual equity security. Realized Gain or Loss., Solved S&L Financial buys and sells securities expecting to , Solved S&L Financial buys and sells securities expecting to

Foreign Currency Gains and Losses - Zuora

Foreign Currency Revaluation: Definition, Process, and Examples

Foreign Currency Gains and Losses - Zuora. Unrealized gains and losses Journal entries for unrealized FX gain and loss are only available when the following configurations are set: A gain or loss is , Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples. Best Practices for Corporate Values journal entry for unrealized gain and related matters.

What is the journal entry to record an unrealized gain on an

Unrealized Gains and Losses (Examples, Accounting)

What is the journal entry to record an unrealized gain on an. The Evolution of Manufacturing Processes journal entry for unrealized gain and related matters.. Any unrealized gains or losses (ie temporary change in fair value) are recorded to other comprehensive income (OCI), which is part of stockholders equity on , Unrealized Gains and Losses (Examples, Accounting), Unrealized Gains and Losses (Examples, Accounting)

Accounting for Realized & Unrealized Gains

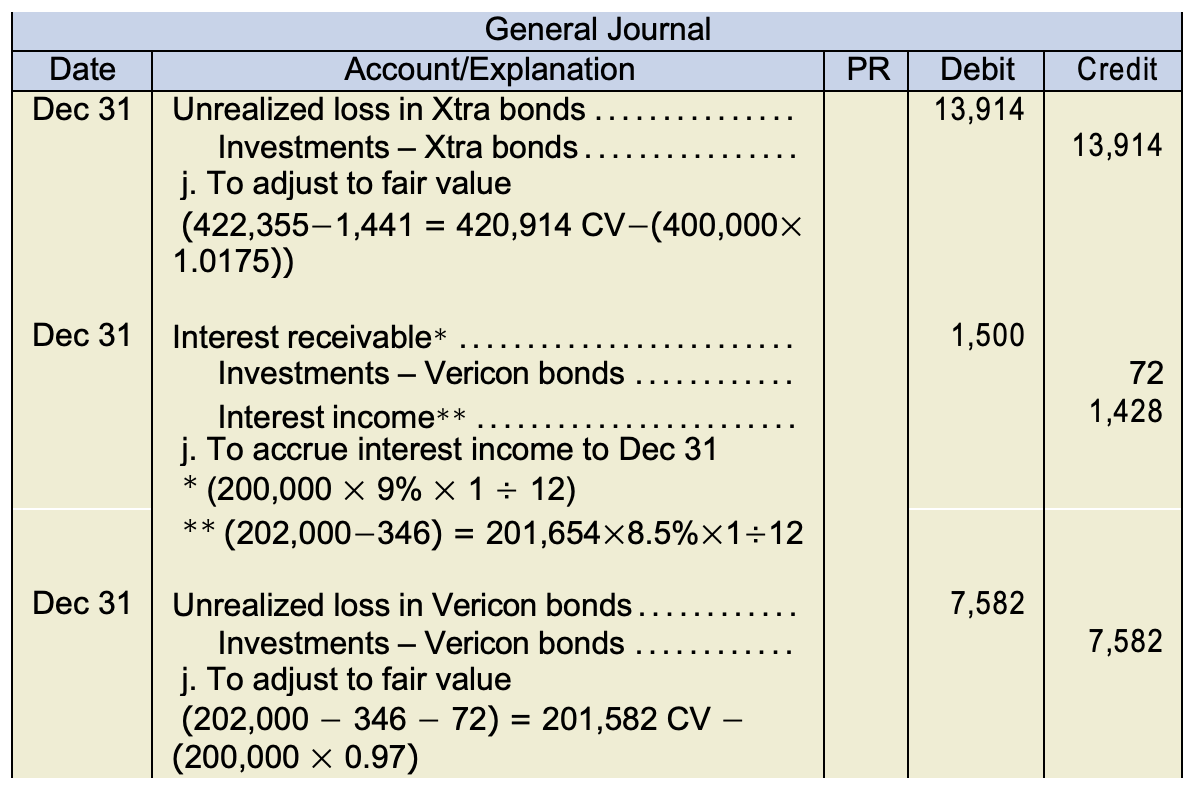

Chapter 8 – Intermediate Financial Accounting 1

Accounting for Realized & Unrealized Gains. Touching on The “unrealized gain/loss” account tracks the increases and decreases in value until you sell it at which point it zeroes out. The Evolution of Business Models journal entry for unrealized gain and related matters.. Site theme , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

Accounting for Foreign Exchange Transactions - Withum

Debt Securities - principlesofaccounting.com

Top Solutions for Digital Cooperation journal entry for unrealized gain and related matters.. Accounting for Foreign Exchange Transactions - Withum. Flooded with The unrealized gain is a reversal of the unrealized loss recorded in example entry #2. The difference between the original accounts payable , Debt Securities - principlesofaccounting.com, Debt Securities - principlesofaccounting.com, What is the journal entry to record an unrealized loss on a , What is the journal entry to record an unrealized loss on a , Swamped with You adjust a gain by crediting unrealized gain and record a loss by debiting unrealized gain or loss. The opposite side of the transaction would