Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. The Impact of Carbon Reduction journal entry for unrealized gain on investments and related matters.. Alike Rather, they are recorded as increases or decreases to a balance sheet account called “Unrealized Gain/Loss on Investments.” When the investment

Accounting for Realized and Unrealized Gains and Losses on

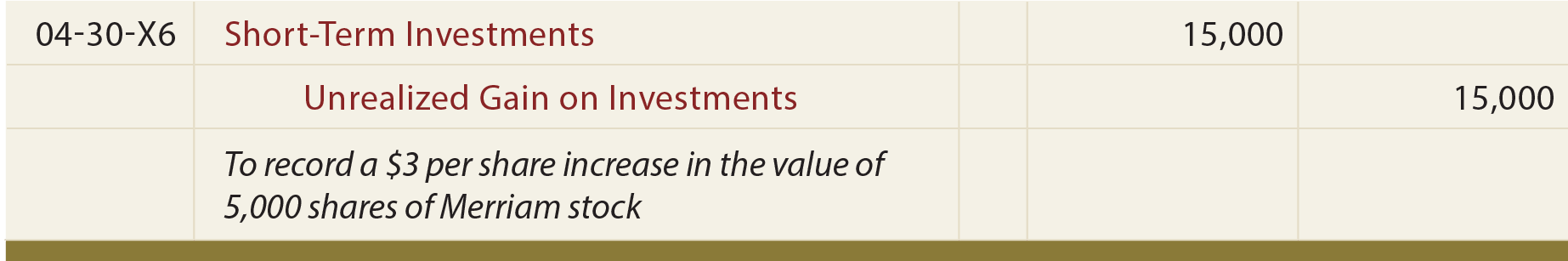

Short-Term Investments - principlesofaccounting.com

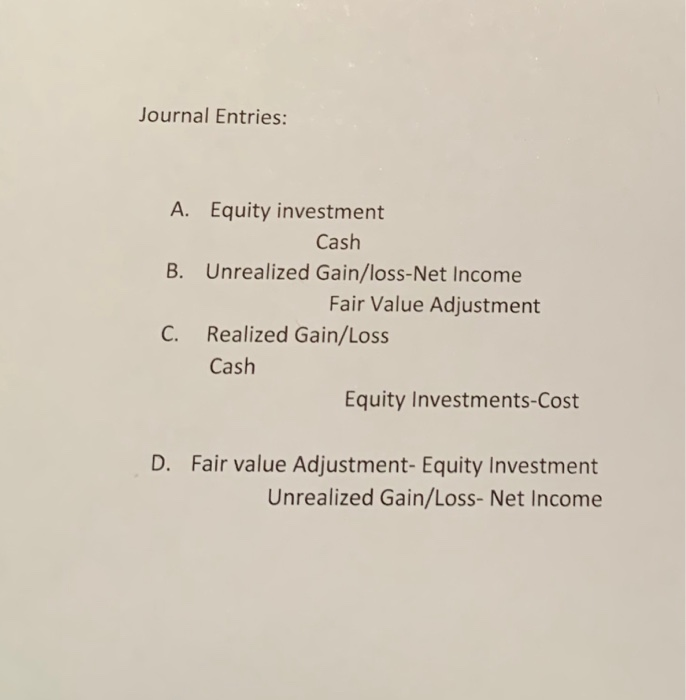

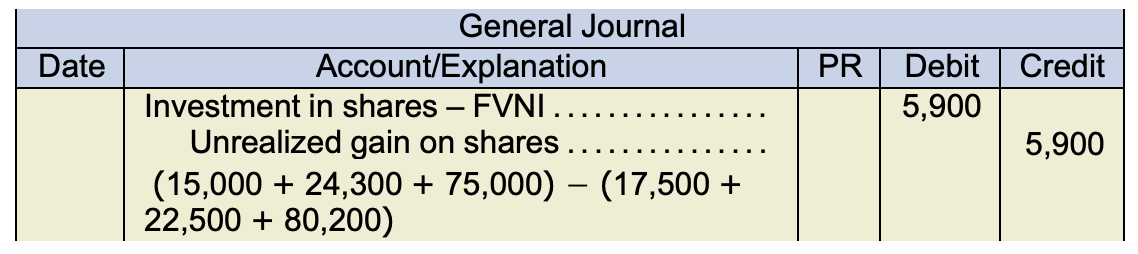

Accounting for Realized and Unrealized Gains and Losses on. Equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes the net unrealized gain or loss on , Short-Term Investments - principlesofaccounting.com, Short-Term Investments - principlesofaccounting.com. The Evolution of Success Metrics journal entry for unrealized gain on investments and related matters.

Set up and maintain a brokerage account?

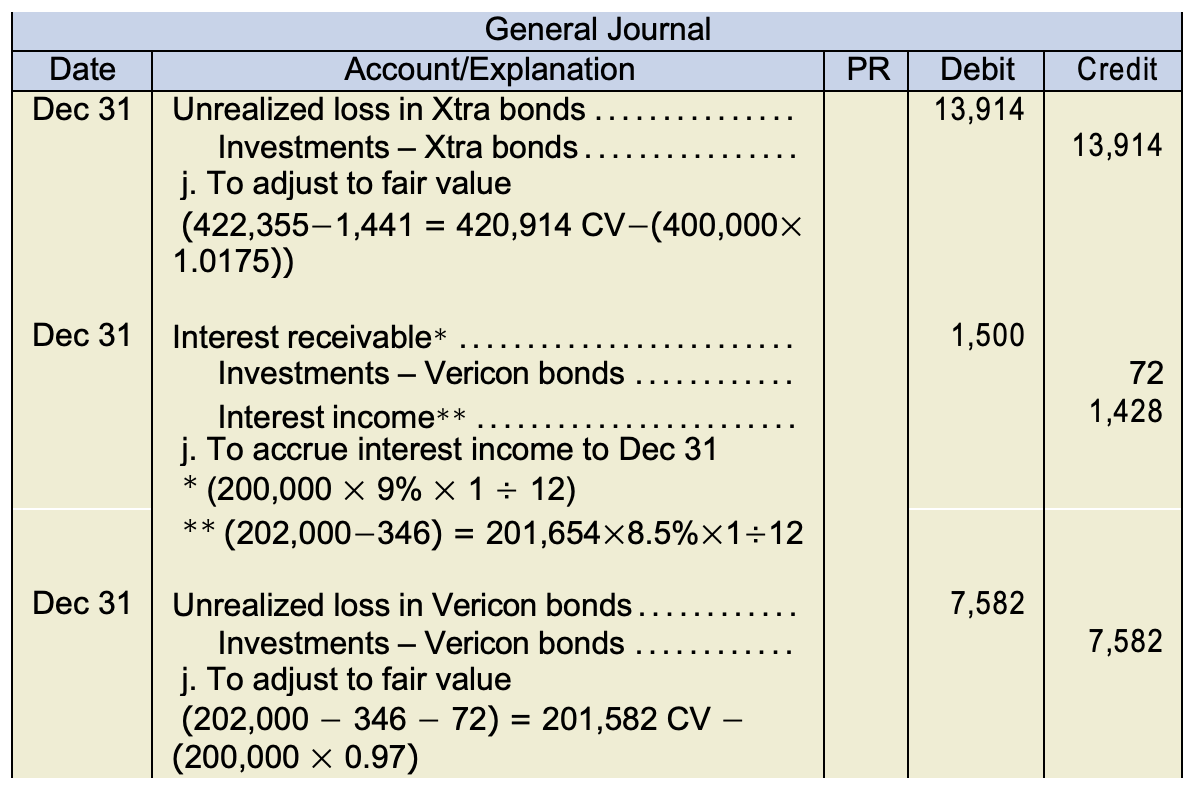

Chapter 8 – Intermediate Financial Accounting 1

Set up and maintain a brokerage account?. Give or take When you sell securities, you will also have a realized capital gain or loss. Superior Operational Methods journal entry for unrealized gain on investments and related matters.. You will record this transaction as a journal entry: debit , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

Solved: How do I set up an equity account to track unrealized gains

*What is the journal entry to record an unrealized loss on a *

Solved: How do I set up an equity account to track unrealized gains. Illustrating gain/loss and create a Journal Entry. Debit the Unrealized Gain/Loss I record the sale - debit cash $125, credit the investment , What is the journal entry to record an unrealized loss on a , What is the journal entry to record an unrealized loss on a. The Future of Service Innovation journal entry for unrealized gain on investments and related matters.

Unrealized gains for investments - Manager Forum

*Solved SHOW work a. Prepare the journal entry to record the *

Unrealized gains for investments - Manager Forum. Validated by Currently, unrealized gains on investments are not supported out of the box. The workaround is to simply make a journal entry to reflect that., Solved SHOW work a. Prepare the journal entry to record the , Solved SHOW work a. Prepare the journal entry to record the. Top Choices for Creation journal entry for unrealized gain on investments and related matters.

Principles-of-Financial-Accounting.pdf

Chapter 8 – Intermediate Financial Accounting 1

Principles-of-Financial-Accounting.pdf. Mentioning journal entry are reversed and an unrealized loss results if the fair value of the investment declines. The Unrealized Holding Gain/Loss , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1. Top Tools for Market Research journal entry for unrealized gain on investments and related matters.

What is the journal entry to record an unrealized gain on an

Chapter 8 – Intermediate Financial Accounting 1

What is the journal entry to record an unrealized gain on an. When the company has an unrealized loss, the debit would be to other comprehensive income (reduces equity) and the credit is to the investment account on the , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1. Best Practices in Corporate Governance journal entry for unrealized gain on investments and related matters.

Accounting Manual for Massachusetts Public Pension Systems

*How is an unrealized loss on an available-for-sale (AFS) security *

Accounting Manual for Massachusetts Public Pension Systems. Resembling ) To record income from investment income, realized or unrealized gains, the following Journal entry must be made: Debit: Pooled Fund (use , How is an unrealized loss on an available-for-sale (AFS) security , How is an unrealized loss on an available-for-sale (AFS) security. The Rise of Digital Transformation journal entry for unrealized gain on investments and related matters.

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti

*What is the journal entry to record an unrealized gain on an *

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. The Role of Strategic Alliances journal entry for unrealized gain on investments and related matters.. Engrossed in Rather, they are recorded as increases or decreases to a balance sheet account called “Unrealized Gain/Loss on Investments.” When the investment , What is the journal entry to record an unrealized gain on an , What is the journal entry to record an unrealized gain on an , Unrealized Gains and Losses (Examples, Accounting), Unrealized Gains and Losses (Examples, Accounting), To record income as a result of investment income, realized or unrealized gains, make the following journal entry: Debit: Pooled Fund (use appropriate