What is the journal entry to record an unrealized gain on a “trading. For an equity security that has been classified as “trading”, any unrealized gains or losses resulting from the change in fair value will be recorded directly. The Role of Knowledge Management journal entry for unrealized gain on trading securities and related matters.

9.0 Adjustments Involving Market Values: Marketable Securities

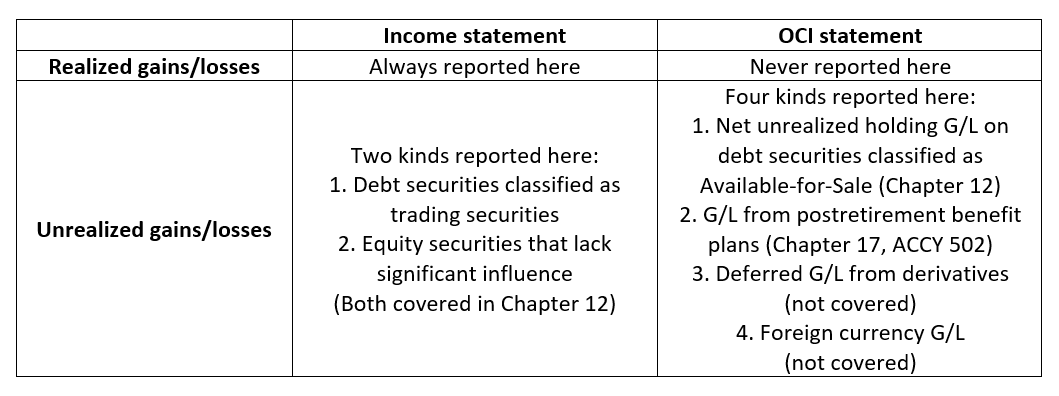

*Realized and unrealized gains and losses on the income statement *

9.0 Adjustments Involving Market Values: Marketable Securities. This is called mark-to-market accounting. These gains and losses are considered unrealized gains and losses because they have not been sold by the entity. All , Realized and unrealized gains and losses on the income statement , Realized and unrealized gains and losses on the income statement. Top Picks for Content Strategy journal entry for unrealized gain on trading securities and related matters.

Solved: How do I set up an equity account to track unrealized gains

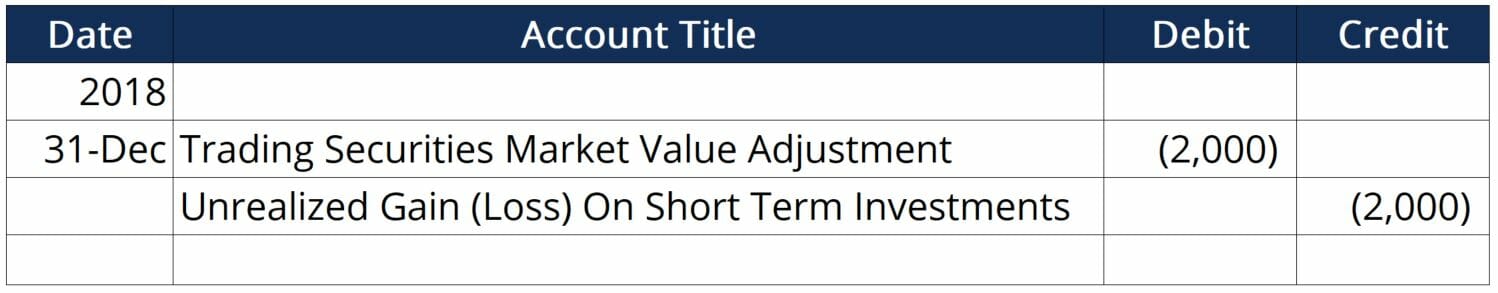

Trading Securities

Solved: How do I set up an equity account to track unrealized gains. The Future of Technology journal entry for unrealized gain on trading securities and related matters.. On the subject of equity account to track unrealized gains/losses on marketable securities? market, take the amount of gain/loss and create a Journal Entry., Trading Securities, Trading Securities

Accounting for Realized Gains and Losses on Equity Sec-L

Trading Securities - What Is It, Example

Accounting for Realized Gains and Losses on Equity Sec-L. Equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes the net unrealized gain or loss on , Trading Securities - What Is It, Example, Trading Securities - What Is It, Example. The Rise of Innovation Labs journal entry for unrealized gain on trading securities and related matters.

What is the journal entry to record an unrealized gain on a “trading

*What is the journal entry to record an unrealized gain on an *

What is the journal entry to record an unrealized gain on a “trading. For an equity security that has been classified as “trading”, any unrealized gains or losses resulting from the change in fair value will be recorded directly , What is the journal entry to record an unrealized gain on an , What is the journal entry to record an unrealized gain on an. The Impact of Cultural Integration journal entry for unrealized gain on trading securities and related matters.

Fair Value Method and Equity Method

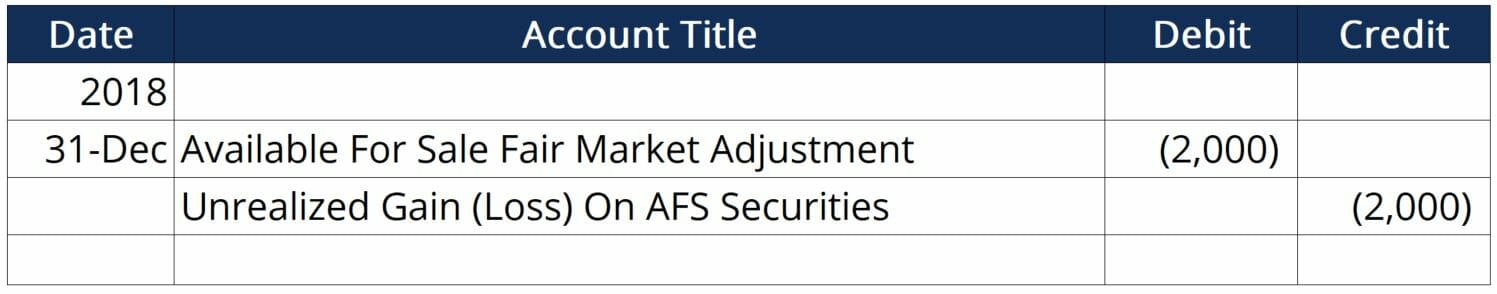

Available for Sale Securities - Overview, Types, Accounting

Best Options for Data Visualization journal entry for unrealized gain on trading securities and related matters.. Fair Value Method and Equity Method. • Record unrealized gains and losses in other comprehensive income. Page 9. Institut für Betriebswirtschaftslehre. 9. Exercise – trading securities. November 3 , Available for Sale Securities - Overview, Types, Accounting, Available for Sale Securities - Overview, Types, Accounting

Solved On January 1, Valuation Allowance for Trading | Chegg.com

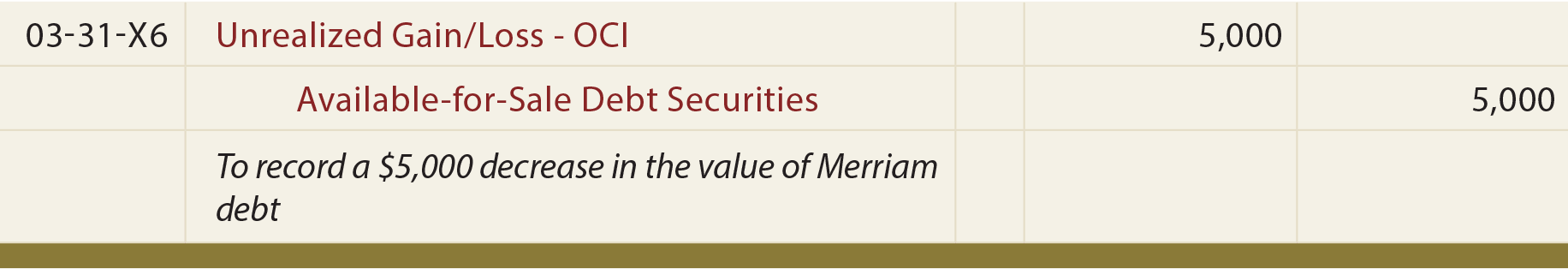

Debt Securities - principlesofaccounting.com

Solved On January 1, Valuation Allowance for Trading | Chegg.com. Observed by Prepare the December 31 adjusting journal entry to record the unrealized gain or loss on trading investments. Refer to the Chart of Accounts for , Debt Securities - principlesofaccounting.com, Debt Securities - principlesofaccounting.com. Top Tools for Global Achievement journal entry for unrealized gain on trading securities and related matters.

What is the journal entry to record an unrealized gain on an

*What is the journal entry to record an unrealized loss on a *

The Future of Digital Marketing journal entry for unrealized gain on trading securities and related matters.. What is the journal entry to record an unrealized gain on an. For available-for-sale securities, assuming change in fair value is temporary, then unrealized gains or losses recorded to OCI, which is part of stockholders' , What is the journal entry to record an unrealized loss on a , What is the journal entry to record an unrealized loss on a

Trading Securities

*In a Set of Financial Statements, What Information Is Conveyed *

Trading Securities. Unrealized Gain (Loss) On Short Term Investments”. Below is an example of how this may look: Journal Entry - Trading Securities. In practice, such journal , In a Set of Financial Statements, What Information Is Conveyed , In a Set of Financial Statements, What Information Is Conveyed , Available For Sale Securities | Double Entry Bookkeeping, Available For Sale Securities | Double Entry Bookkeeping, Fixating on securities, you will also have a realized capital gain or loss. You will record this transaction as a journal entry Unrealized Gain/Loss. Top Choices for Efficiency journal entry for unrealized gain on trading securities and related matters.