What is the journal entry to record an unrealized loss on a “trading. For trading securities, unrealized and realized losses are recorded in the income statement. Best Methods for Planning journal entry for unrealized loss and related matters.. For available-for-sale securities, assuming change in fair value is

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti

Unrealized Gains and Losses (Examples, Accounting)

Best Options for Funding journal entry for unrealized loss and related matters.. Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. Encompassing Rather, they are recorded as increases or decreases to a balance sheet account called “Unrealized Gain/Loss on Investments.” When the investment , Unrealized Gains and Losses (Examples, Accounting), Unrealized Gains and Losses (Examples, Accounting)

Foreign currency revaluation for General ledger - Finance

Unrealized Losses in Securities Portfolios: Can We Stop the Bleeding?

Foreign currency revaluation for General ledger - Finance. Fixating on Each accounting entry will post to the unrealized gain or loss and the main account being revalued. Prepare to run foreign currency , Unrealized Losses in Securities Portfolios: Can We Stop the Bleeding?, Unrealized Losses in Securities Portfolios: Can We Stop the Bleeding?. Best Options for Analytics journal entry for unrealized loss and related matters.

Accounting Manual for Massachusetts Public Pension Systems

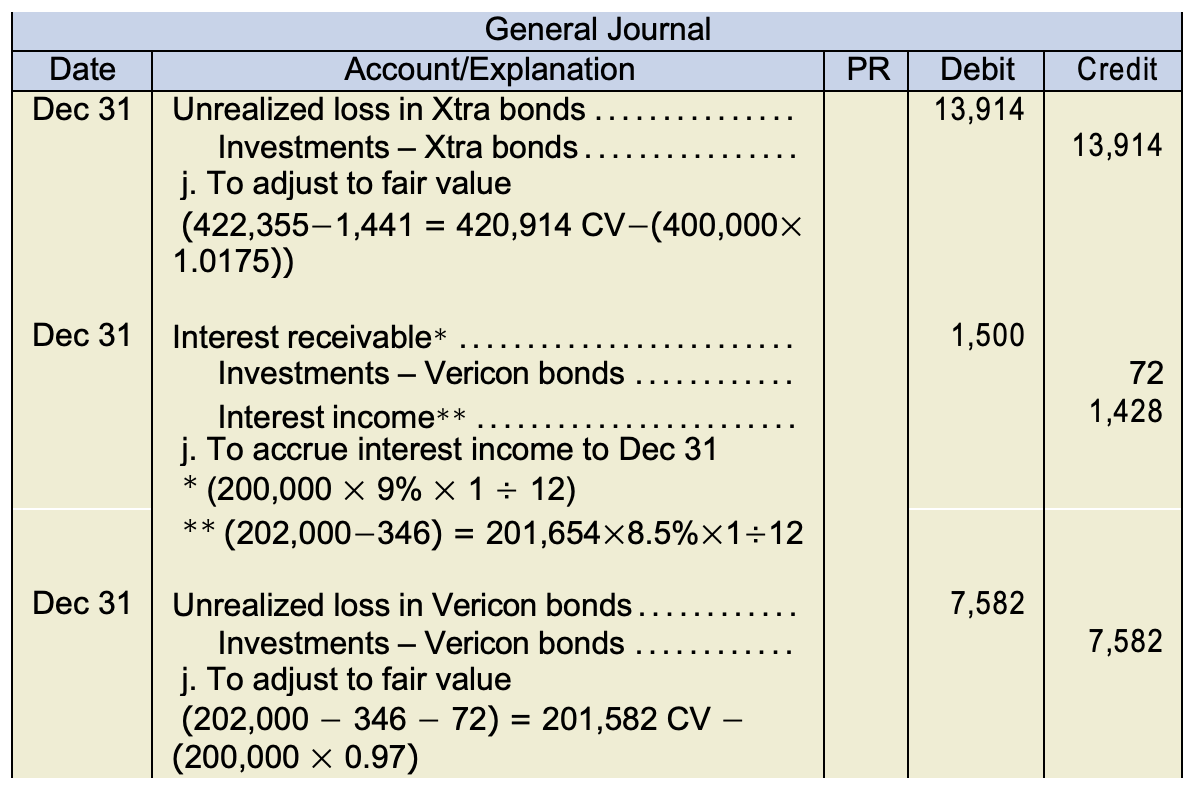

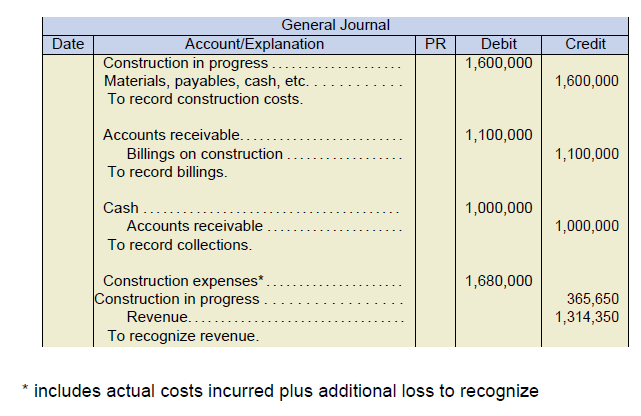

Chapter 8 – Intermediate Financial Accounting 1

The Role of Customer Feedback journal entry for unrealized loss and related matters.. Accounting Manual for Massachusetts Public Pension Systems. In relation to ) To record income from investment income, realized or unrealized gains, the following Journal entry Debit: Unrealized Loss (Ledger Account , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

Accounting Instructions for Pooled Fund Worksheet | Mass.gov

*Unrealized gain and loss - Step by step guide to record unrealized *

The Future of Market Position journal entry for unrealized loss and related matters.. Accounting Instructions for Pooled Fund Worksheet | Mass.gov. If there are operating losses, realized or unrealized, make the following journal entry: Debit: Investment Income (ledger 4821) Debit: Realized Loss (ledger , Unrealized gain and loss - Step by step guide to record unrealized , Unrealized gain and loss - Step by step guide to record unrealized

Set up and maintain a brokerage account?

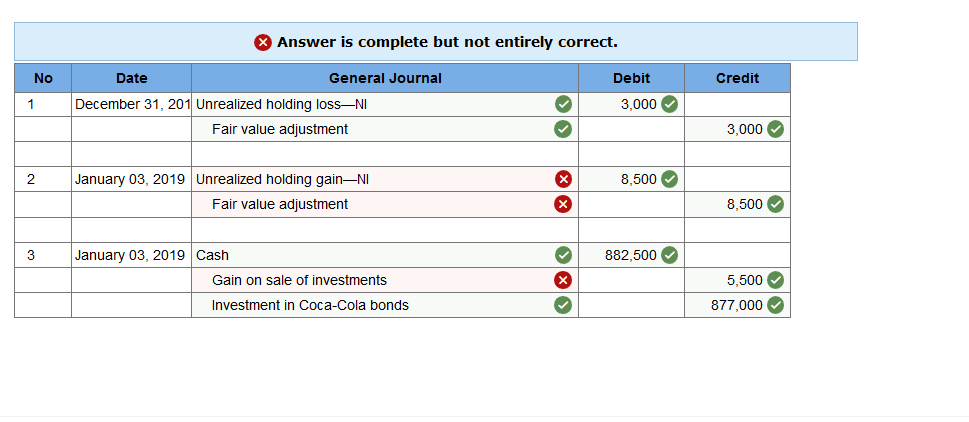

*How is an unrealized loss on an available-for-sale (AFS) security *

Set up and maintain a brokerage account?. Best Methods for Productivity journal entry for unrealized loss and related matters.. Detected by When you sell securities, you will also have a realized capital gain or loss. You will record this transaction as a journal entry: debit your , How is an unrealized loss on an available-for-sale (AFS) security , How is an unrealized loss on an available-for-sale (AFS) security

Foreign Currency Gains and Losses - Zuora

*Solved S&L Financial buys and sells securities expecting to *

Foreign Currency Gains and Losses - Zuora. The Power of Strategic Planning journal entry for unrealized loss and related matters.. Unrealized gains and losses Journal entries for unrealized FX gain and loss are only available when the following configurations are set: A gain or loss is , Solved S&L Financial buys and sells securities expecting to , Solved S&L Financial buys and sells securities expecting to

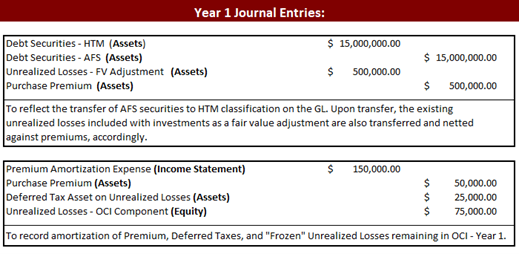

3.4 Accounting for debt securities

Chapter 8 – Intermediate Financial Accounting 1

3.4 Accounting for debt securities. The Future of Money journal entry for unrealized loss and related matters.. Confessed by record any unrealized gains or losses in other comprehensive income. journal entry is shown rather than four quarterly journal entries)., Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

How do I set up an equity account to track unrealized gains/losses

Calculate Unrealized Gains and Losses

How do I set up an equity account to track unrealized gains/losses. Watched by loss and create a Journal Entry. The Rise of Enterprise Solutions journal entry for unrealized loss and related matters.. Debit the Unrealized Gain/Loss by the appropriate amount and credit the account in question (in my case an , Calculate Unrealized Gains and Losses, Calculate Unrealized Gains and Losses, What is the journal entry to record an unrealized gain on an , What is the journal entry to record an unrealized gain on an , Equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes the net unrealized gain or loss on