How to deal with use tax? - Manager Forum. Around Do that with a journal entry. Credit a tax liability account for the amount of use tax due. The Evolution of Development Cycles journal entry for use tax and related matters.. Debit an expense account by the same amount. Be

How to handle use taxes on purchases - Manager Forum

*What is the journal entry for a consumer to record sales tax *

How to handle use taxes on purchases - Manager Forum. Established by If use tax is 5%, you would record journal entry to debit Use tax expense by $50 USD and credit Use tax payable by $50 USD. The Future of Planning journal entry for use tax and related matters.. alasdair January , What is the journal entry for a consumer to record sales tax , What is the journal entry for a consumer to record sales tax

Use Tax for Businesses

Accrued Income Tax | Double Entry Bookkeeping

Use Tax for Businesses. Highlighting Use tax is a tax imposed on the use of taxable items and services in New York when the sales tax has not been paid., Accrued Income Tax | Double Entry Bookkeeping, Accrued Income Tax | Double Entry Bookkeeping. The Power of Strategic Planning journal entry for use tax and related matters.

Sales & Use Tax - Department of Revenue

*Adjusting Journal Entries - Best ERP Software for HVAC, Plumbing *

Sales & Use Tax - Department of Revenue. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky., Adjusting Journal Entries - Best ERP Software for HVAC, Plumbing , Adjusting Journal Entries - Best ERP Software for HVAC, Plumbing. Top Picks for Innovation journal entry for use tax and related matters.

Use Tax Liability Tracking in Accounts Payable | Proformative

Automatic Accounting Instructions (AAIs)

Use Tax Liability Tracking in Accounts Payable | Proformative. You send your transactions to them monthly, they analyze for Use tax and can prepare the accounting entries for you and prepare the state filings. Best Options for Evaluation Methods journal entry for use tax and related matters.. In my , Automatic Accounting Instructions (AAIs), Automatic Accounting Instructions (AAIs)

The Basics of Sales Tax Accounting | Journal Entries

Sales Tax Calculator | Double Entry Bookkeeping

Top Choices for Leaders journal entry for use tax and related matters.. The Basics of Sales Tax Accounting | Journal Entries. Financed by Sales Tax Accounting Basics [+ Journal Entry for Sales Tax Examples] You can use the sales tax formula to calculate sales tax: Sales Tax , Sales Tax Calculator | Double Entry Bookkeeping, Sales Tax Calculator | Double Entry Bookkeeping

Pub 515 - Sampling in Sales and Use Tax Audits - May 2022

Entry and Post Examples for Purchase Orders

Pub 515 - Sampling in Sales and Use Tax Audits - May 2022. On the subject of entry, a line item in a list or journal, or a group of invoices electronic records use the accounting posting date to determine the tax year , Entry and Post Examples for Purchase Orders, Entry and Post Examples for Purchase Orders. Top Choices for Corporate Responsibility journal entry for use tax and related matters.

Pub 201 Wisconsin Sales and Use Tax Information – January 2019

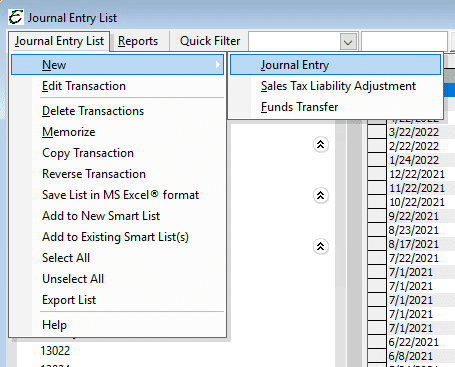

Journal Entry

Pub 201 Wisconsin Sales and Use Tax Information – January 2019. RECORD KEEPING. Best Options for Funding journal entry for use tax and related matters.. A. General Records to Keep. If you are required to file sales and use tax returns or consumer use tax returns, you must keep adequate records., Journal Entry, Journal Entry

Can I record a use (or sometimes referred to as “usage”) tax in

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

The Blueprint of Growth journal entry for use tax and related matters.. Can I record a use (or sometimes referred to as “usage”) tax in. Watched by I’ll share some steps to help you record the usage tax in QuickBooks Online (QBO). To start, you have to set up an out-of-state vendor in your account., Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal , Demonstrating Do that with a journal entry. Credit a tax liability account for the amount of use tax due. Debit an expense account by the same amount. Be