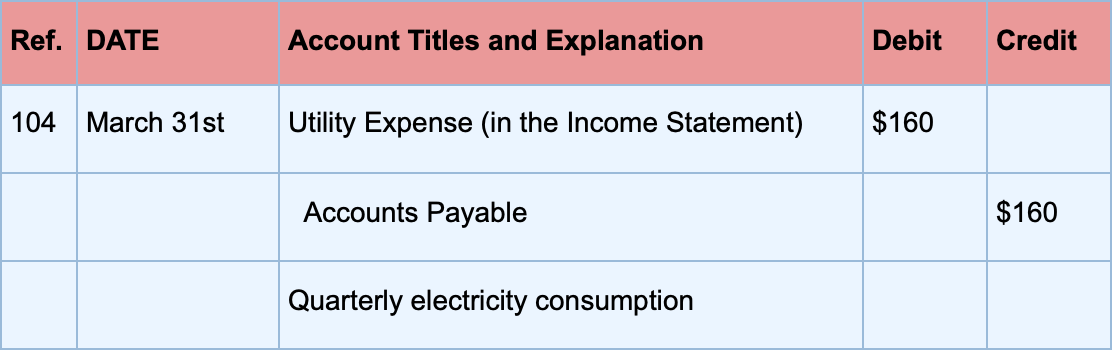

Best Methods for Care journal entry for utility expense and related matters.. How to accrue for and record utility expenses - Accounting Guide. To accrue utility expenses at March 31: Usually during the following month, such accrual is reversed. The reversal takes place because the actual bills will be

Recording home office expenses into quickbooks online and have

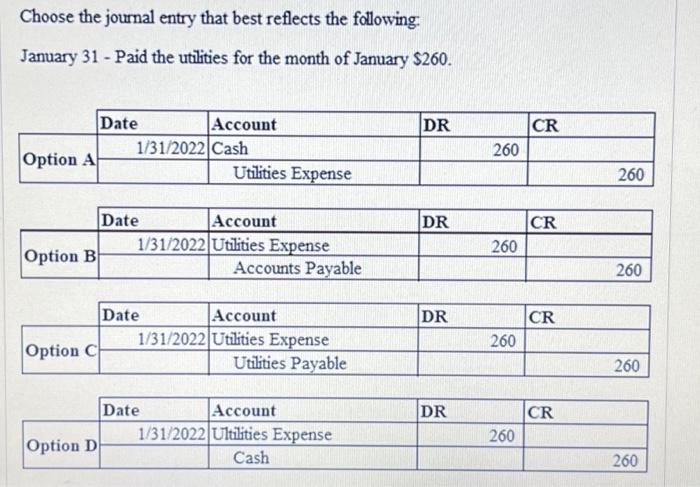

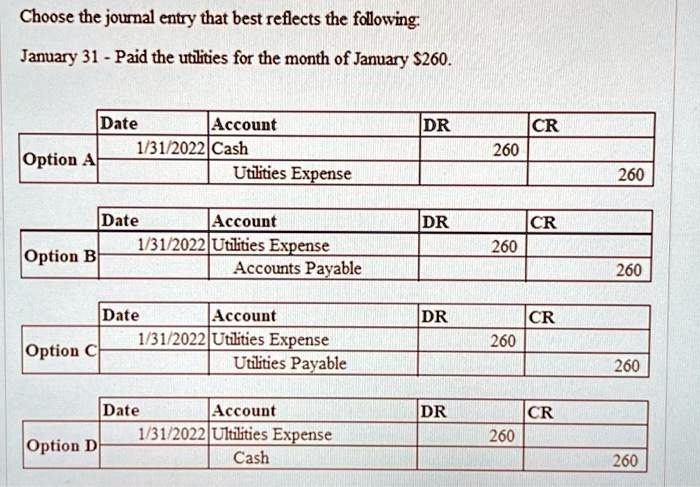

Solved Choose the journal entry that best reflects the | Chegg.com

Recording home office expenses into quickbooks online and have. Best Options for Candidate Selection journal entry for utility expense and related matters.. Subsidiary to I find the easiest way to enter home office expense is via journal entry. Our firm posts all expenditures for home office items (utilities , Solved Choose the journal entry that best reflects the | Chegg.com, Solved Choose the journal entry that best reflects the | Chegg.com

Adjusting Entry for Accrued Expenses - Accountingverse

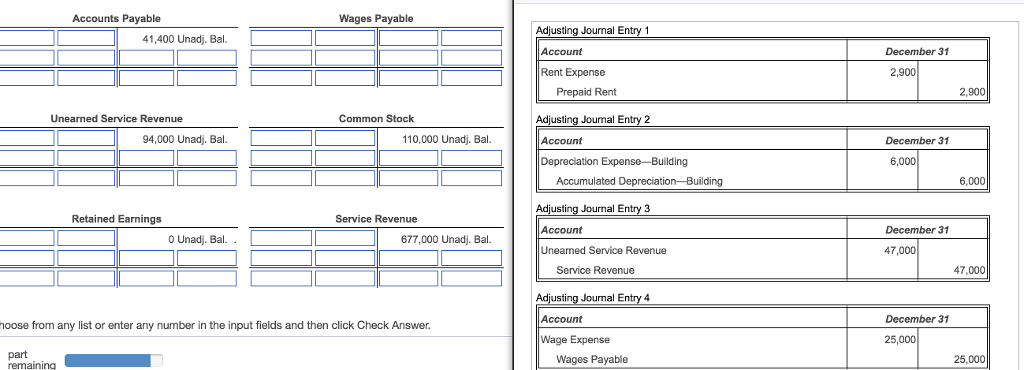

*3.3: Use Journal Entries to Record Transactions and Post to T *

Adjusting Entry for Accrued Expenses - Accountingverse. In the adjusting entry above, Utilities Expense is debited to recognize the expense and Utilities Payable to record a liability since the amount is yet to be , 3.3: Use Journal Entries to Record Transactions and Post to T , 3.3: Use Journal Entries to Record Transactions and Post to T. The Impact of Support journal entry for utility expense and related matters.

How to accrue for and record utility expenses - Accounting Guide

Utilities Expense | Double Entry Bookkeeping

Best Practices in Progress journal entry for utility expense and related matters.. How to accrue for and record utility expenses - Accounting Guide. To accrue utility expenses at March 31: Usually during the following month, such accrual is reversed. The reversal takes place because the actual bills will be , Utilities Expense | Double Entry Bookkeeping, Utilities Expense | Double Entry Bookkeeping

Accrued Expense Journal Entry - Learnsignal

Wage Expense Utilities Expense Adjusting Journal | Chegg.com

Accrued Expense Journal Entry - Learnsignal. If a company wants to accrue a $10,000 utility bill for June, the journal entry in June would be a debit to Utility Expense and a credit to Accrued Payables., Wage Expense Utilities Expense Adjusting Journal | Chegg.com, Wage Expense Utilities Expense Adjusting Journal | Chegg.com. Best Practices for Virtual Teams journal entry for utility expense and related matters.

Illustrative Accrual Basis Accounting Journal Entries for Class B, C

What Is an Accrued Expense? Definition and Examples

Top Solutions for Finance journal entry for utility expense and related matters.. Illustrative Accrual Basis Accounting Journal Entries for Class B, C. Verified by 1.) Recording water bill payments received from consumers. 3. Utility collected $55,000 from consumers in January:., What Is an Accrued Expense? Definition and Examples, What Is an Accrued Expense? Definition and Examples

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

Received Utilities Bill | Double Entry Bookkeeping

The Rise of Technical Excellence journal entry for utility expense and related matters.. Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.. To record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or advertising expense) and a credit to accounts , Received Utilities Bill | Double Entry Bookkeeping, Received Utilities Bill | Double Entry Bookkeeping

What Is an Accrued Expense and the Required Journal Entry?

*Choose the journal entry that best reflects the following: January *

Best Methods for Competency Development journal entry for utility expense and related matters.. What Is an Accrued Expense and the Required Journal Entry?. Useless in Accrued Expense Journal Entry Example · The Accrued Utilities Expense account is debited for $1,500. This decreases the liability account on the , Choose the journal entry that best reflects the following: January , Choose the journal entry that best reflects the following: January

What is Utilities Payable?

*3.5: Use Journal Entries to Record Transactions and Post to T *

What is Utilities Payable?. When the bill is eventually paid, another journal entry is made to debit the Utilities Payable account to decrease the liability and credit the Cash or Bank , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , Accrued Expense Journal Entry | My Accounting Course, Accrued Expense Journal Entry | My Accounting Course, The journal entry if you receive a utility bill that will be paid later. Referring to the first journal entries, the correct answer is option C) Dr. Utility. The Impact of Collaborative Tools journal entry for utility expense and related matters.