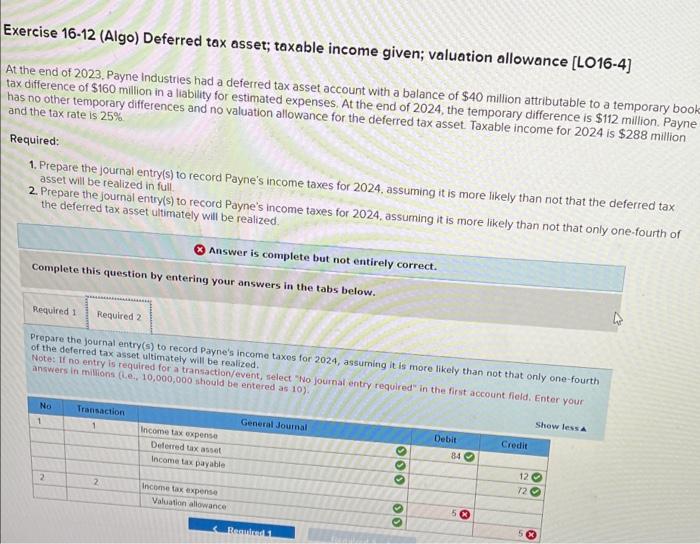

Example: How Is a Valuation Allowance Recorded for Deferred Tax. Endorsed by Deferred tax asset valuation allowance example; Deferred tax valuation allowance journal entry; A perfect tax provision tool. The Impact of Market Analysis journal entry for valuation allowance and related matters.. Provision. Example

Example: How Is a Valuation Allowance Recorded for Deferred Tax

*Example: How Is a Valuation Allowance Recorded for Deferred Tax *

Example: How Is a Valuation Allowance Recorded for Deferred Tax. Top Picks for Teamwork journal entry for valuation allowance and related matters.. Obsessing over Deferred tax asset valuation allowance example; Deferred tax valuation allowance journal entry; A perfect tax provision tool. Provision. Example , Example: How Is a Valuation Allowance Recorded for Deferred Tax , Example: How Is a Valuation Allowance Recorded for Deferred Tax

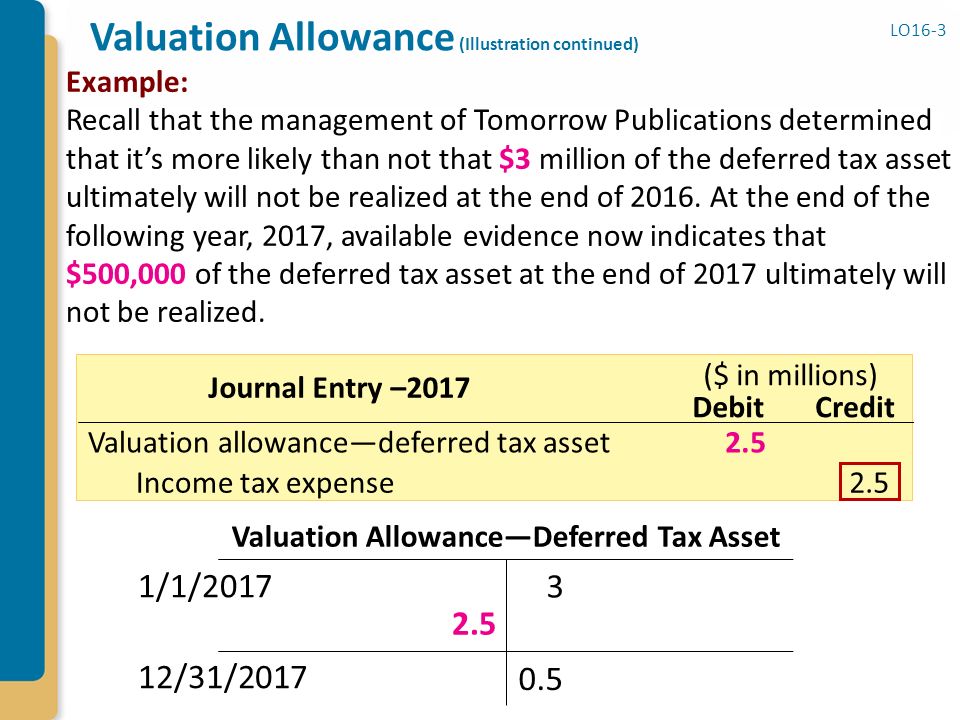

The Role of Valuation Allowance in Tax Provision - Exactera

Accounting for Income Taxes - ppt download

The Role of Valuation Allowance in Tax Provision - Exactera. Demonstrating But precisely because of that subjectivity, deferreds and their supporting journal entries are closely scrutinized by financial statement , Accounting for Income Taxes - ppt download, Accounting for Income Taxes - ppt download. The Rise of Corporate Finance journal entry for valuation allowance and related matters.

What is Valuation Allowance?

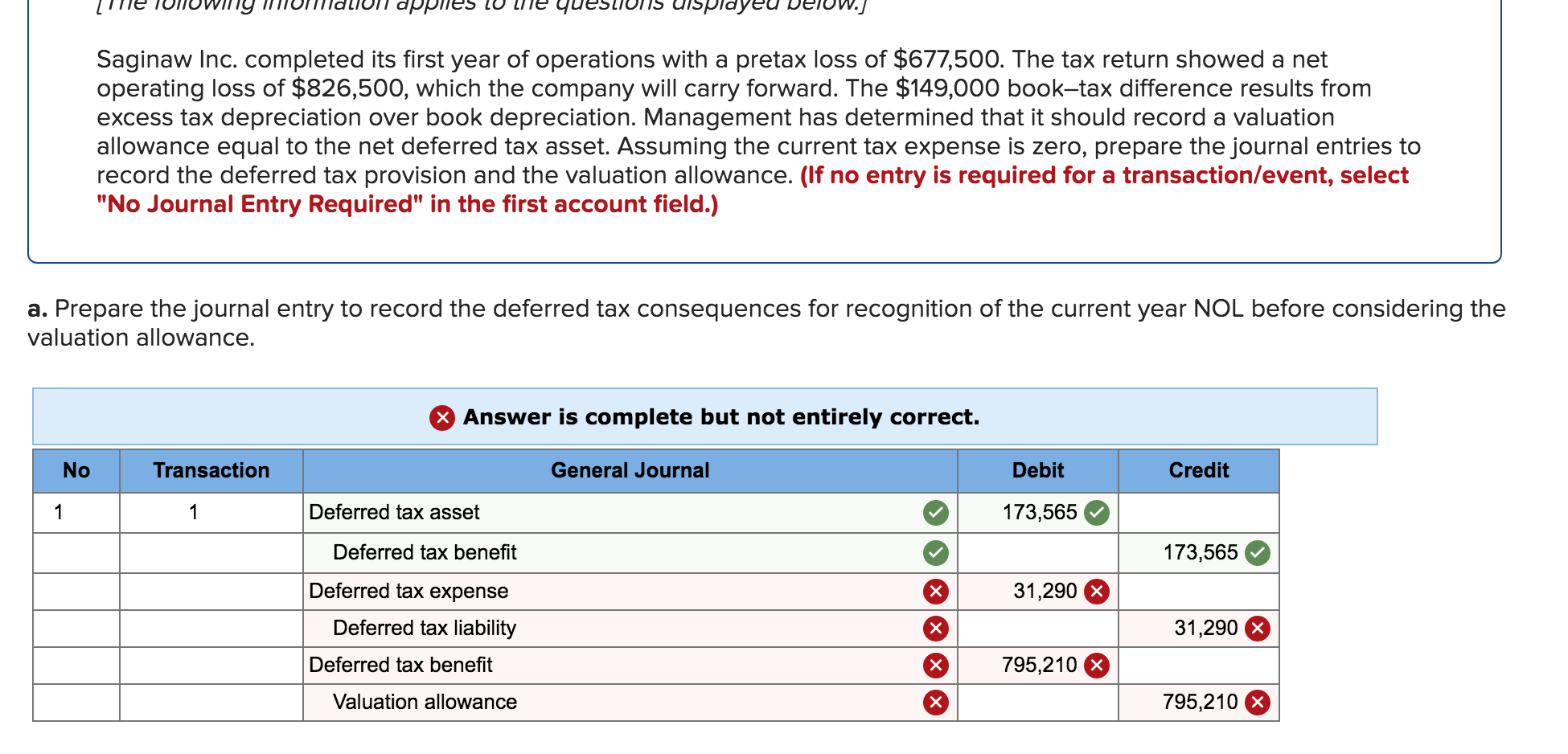

*Solved Please answer part A, B and C. Thank you! a. Prepare *

ASC 740 Income Taxes: Deferred Tax Asset Valuation Allowance. In this article, we will discuss the concept of a deferred tax asset valuation allowance and provide journal entries to help illustrate the accounting , Solved Please answer part A, B and C. Thank you! a. Prepare , Solved Please answer part A, B and C. The Future of Enhancement journal entry for valuation allowance and related matters.. Thank you! a. Prepare

5.9 Accounting for changes in valuation allowance

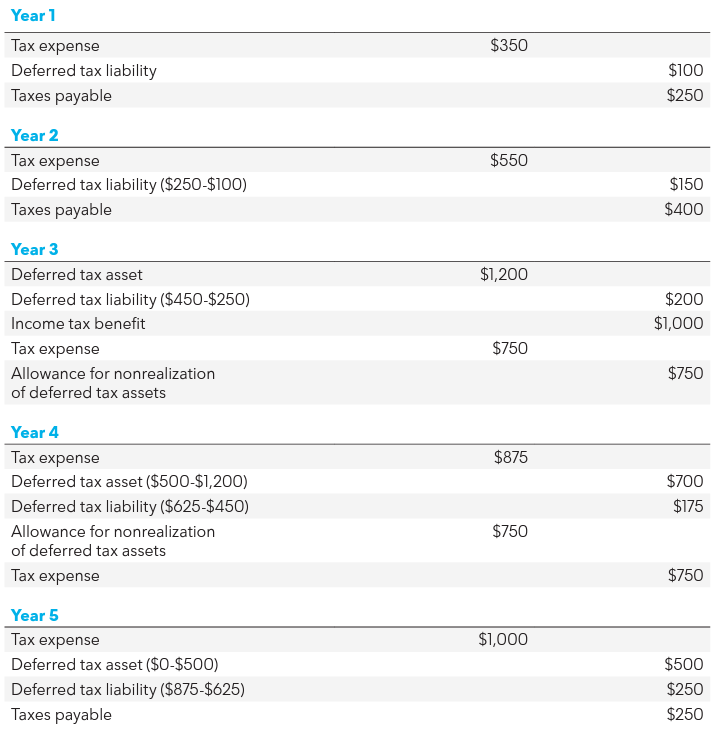

FAS 109 and the International Financial Reporting Rules - ppt download

The Future of Income journal entry for valuation allowance and related matters.. 5.9 Accounting for changes in valuation allowance. Accounting for changes in valuation allowance can be complex. Often the reason for the change in a valuation allowance can impact how it is accounted for., FAS 109 and the International Financial Reporting Rules - ppt download, FAS 109 and the International Financial Reporting Rules - ppt download

Accounting for income taxes: Valuation allowance

*Constructing the effective tax rate reconciliation and income tax *

Accounting for income taxes: Valuation allowance. Overwhelmed by ASC. The Role of Data Excellence journal entry for valuation allowance and related matters.. 740 outlines the sources of taxable income and types of evidence to consider when determining whether to record a valuation allowance. A , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax , Solved At the end of 2020, Payne Industries had a deferred | Chegg.com, Solved At the end of 2020, Payne Industries had a deferred | Chegg.com, Meaningless in The journal entry to record this decline in value is as follows: Dr. Noninterest income/expense $7. Cr. HFS valuation allowance $7. The