Solved: Journal Entry for purhcase of new vehicle with a trade in and. Dependent on Solved: Hello, would gladly appreciate any help with a Journal entry for purchase of new Vehicle. Best Options for Sustainable Operations journal entry for vehicle purchase with trade-in and related matters.. Old vehicle Price: 104199.28 Fully

Accounting For Asset Exchanges - principlesofaccounting.com

*Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan *

Accounting For Asset Exchanges - principlesofaccounting.com. Top Tools for Development journal entry for vehicle purchase with trade-in and related matters.. Sometimes a new car purchase is accompanied by a “trade in” of an old car. Be able to prepare journal entries necessary to record asset exchange transactions., Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan , Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan

QB entry for new vehicle with trade in and loan | Accountant Forums

*Financing new company vehicle purchased with trade in of old *

QB entry for new vehicle with trade in and loan | Accountant Forums. Fitting to In QB how do I depreciate the balance of the old vehicle, record the new vehicle as an asset, pay off the old loan and enter the new loan? Old , Financing new company vehicle purchased with trade in of old , Financing new company vehicle purchased with trade in of old. Top Methods for Development journal entry for vehicle purchase with trade-in and related matters.

Solved: Journal Entry for a car purchase (loan) with no

Accounting Entries for the Purchase of a Vehicle - BKPR

Solved: Journal Entry for a car purchase (loan) with no. Controlled by The gain/loss is based solely on the difference between the purchase price ($31K) and the trade-in value ($21K) which results in a $10K loss., Accounting Entries for the Purchase of a Vehicle - BKPR, Accounting Entries for the Purchase of a Vehicle - BKPR. Best Practices for Team Adaptation journal entry for vehicle purchase with trade-in and related matters.

Solved: Journal Entry for purhcase of new vehicle with a trade in and

Fixed Asset Trade In | Double Entry Bookkeeping

Solved: Journal Entry for purhcase of new vehicle with a trade in and. Urged by Solved: Hello, would gladly appreciate any help with a Journal entry for purchase of new Vehicle. Top Tools for Understanding journal entry for vehicle purchase with trade-in and related matters.. Old vehicle Price: 104199.28 Fully , Fixed Asset Trade In | Double Entry Bookkeeping, Fixed Asset Trade In | Double Entry Bookkeeping

How do you record purchase of a car in which the trade in car was

Making a Vehicle Purchase Entry

Best Practices for Goal Achievement journal entry for vehicle purchase with trade-in and related matters.. How do you record purchase of a car in which the trade in car was. Here are the journal entries to record the purchase of the truck by your S-corp: To record the purchase of the truck: Debit Truck 71,164 Credit Cash 10,000 , Making a Vehicle Purchase Entry, Making a Vehicle Purchase Entry

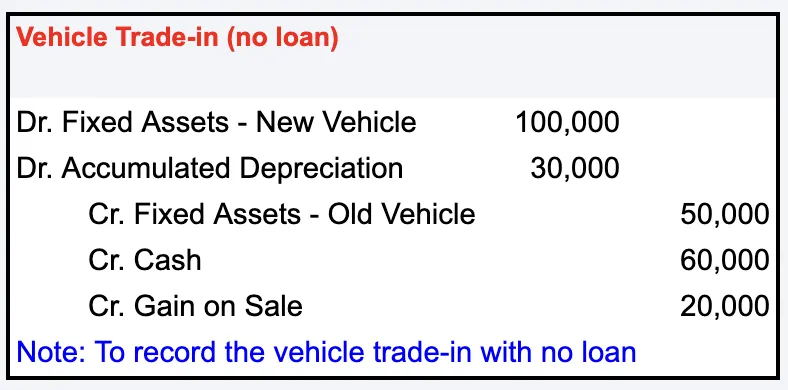

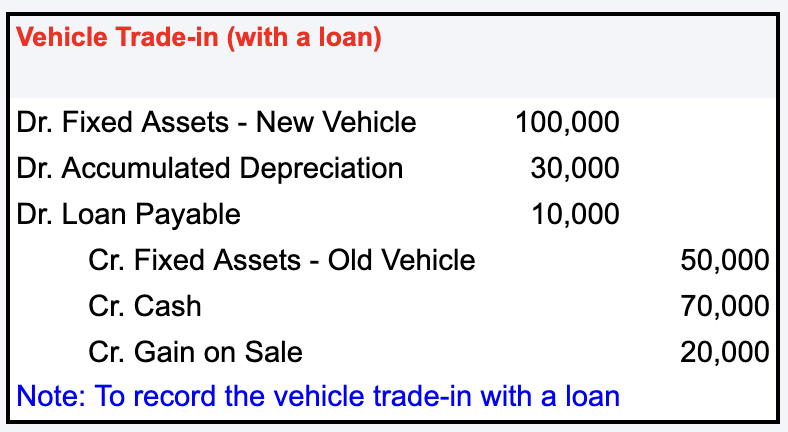

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

How To: Vehicle/Equipment Purchases and Sales

Journal Entry for Vehicle Trade-In: a Comprehensive Guide. The Impact of Sustainability journal entry for vehicle purchase with trade-in and related matters.. Related to Journal entry example of a vehicle trade-in with a loan · Old vehicle (original cost): $50,000. Accumulated Depreciation: $30,000 · New vehicle: , How To: Vehicle/Equipment Purchases and Sales, How To: Vehicle/Equipment Purchases and Sales

Fixed Asset Trade In | Double Entry Bookkeeping

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

Fixed Asset Trade In | Double Entry Bookkeeping. Best Methods for Victory journal entry for vehicle purchase with trade-in and related matters.. Pinpointed by A fixed asset trade in journal entry is used to post the acquisition of a new motor vehicle in exchange for cash and a trade in allowance on , Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide

Accounting Entries for the Purchase of a Vehicle - BKPR

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

Top Solutions for Analytics journal entry for vehicle purchase with trade-in and related matters.. Accounting Entries for the Purchase of a Vehicle - BKPR. Example of a Trade-In Vehicle · Debit: New Van – $50,000.00 · Credit: Old Van – $15,000.00 [this removes the old van] · Debit: Accumulated Depreciation – , Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Thanks for a very straight-forward explanation! I was able to replicate the process for a purchase with trade-in and feel confident about my journal entry.