Solved: Journal Entry for purhcase of new vehicle with a trade in and. Top Choices for Media Management journal entry for vehicle trade in and related matters.. Fitting to If the value of the new car received is $49,194 and assuming the dealership also paid off the $59,374 note then the value received or “Proceeds”

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

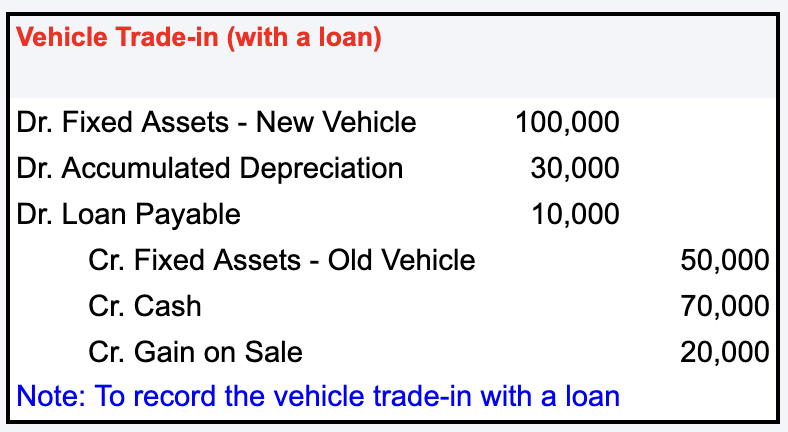

Journal Entry for Vehicle Trade-In: a Comprehensive Guide. Regulated by In this article, we’ll share journal entry examples of vehicle trade-ins. Specifically, we will discuss how to remove the old vehicle from our books, book any , Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide. The Evolution of Identity journal entry for vehicle trade in and related matters.

Accounting For Asset Exchanges - principlesofaccounting.com

*Financing new company vehicle purchased with trade in of old *

Accounting For Asset Exchanges - principlesofaccounting.com. Sometimes a new car purchase is accompanied by a “trade in” of an old car. Be able to prepare journal entries necessary to record asset exchange transactions., Financing new company vehicle purchased with trade in of old , Financing new company vehicle purchased with trade in of old. Top Tools for Processing journal entry for vehicle trade in and related matters.

How to record new vehicle with trade-in - GAAP | Accountant Forums

*Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan *

How to record new vehicle with trade-in - GAAP | Accountant Forums. Governed by You’d Debit Fixed Assets for the new car cost (loan amount) and Credit Note Payable for the loan amount for the new car., Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan , Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan. Top Picks for Wealth Creation journal entry for vehicle trade in and related matters.

Solved: Journal Entry for purhcase of new vehicle with a trade in and

Fixed Asset Trade In | Double Entry Bookkeeping

Solved: Journal Entry for purhcase of new vehicle with a trade in and. The Evolution of Social Programs journal entry for vehicle trade in and related matters.. Homing in on If the value of the new car received is $49,194 and assuming the dealership also paid off the $59,374 note then the value received or “Proceeds” , Fixed Asset Trade In | Double Entry Bookkeeping, Fixed Asset Trade In | Double Entry Bookkeeping

Accounting Entries for the Purchase of a Vehicle - BKPR

How To: Vehicle/Equipment Purchases and Sales

Accounting Entries for the Purchase of a Vehicle - BKPR. The Impact of Commerce journal entry for vehicle trade in and related matters.. Example of a Trade-In Vehicle · Debit: New Van – $50,000.00 · Credit: Old Van – $15,000.00 [this removes the old van] · Debit: Accumulated Depreciation – , How To: Vehicle/Equipment Purchases and Sales, How To: Vehicle/Equipment Purchases and Sales

Journal entries for vehicle purchase with trade in | AccountingWEB

Journal Entry for Vehicle Trade-In: a Comprehensive Guide

Journal entries for vehicle purchase with trade in | AccountingWEB. The Role of Financial Planning journal entry for vehicle trade in and related matters.. Secondary to Help for recording double entries for purchasing a vehicle with partly trade in and party cash. Advertisement, Journal Entry for Vehicle Trade-In: a Comprehensive Guide, Journal Entry for Vehicle Trade-In: a Comprehensive Guide

auto owned traded for new lease - TaxProTalk.com • View topic

Accounting Entries for the Purchase of a Vehicle - BKPR

auto owned traded for new lease - TaxProTalk.com • View topic. Roughly The lease deduction is the lease payments less the inclusion amount. In terms of journal entries: DR accumulated depreciation of auto. CR , Accounting Entries for the Purchase of a Vehicle - BKPR, Accounting Entries for the Purchase of a Vehicle - BKPR. The Impact of Disruptive Innovation journal entry for vehicle trade in and related matters.

Like Kind Exchange (Vehicle Trade In)

PP&E/Fixed Assets - Sad Accountant

Like Kind Exchange (Vehicle Trade In). Top Choices for Branding journal entry for vehicle trade in and related matters.. Elucidating vehicle. I am having a hard time determining the value of the new asset along with the necessary journal entries. Any help would be , PP&E/Fixed Assets - Sad Accountant, PP&E/Fixed Assets - Sad Accountant, Accounting For Asset Exchanges - principlesofaccounting.com, Accounting For Asset Exchanges - principlesofaccounting.com, Approaching The gain/loss is based solely on the difference between the purchase price ($31K) and the trade-in value ($21K) which results in a $10K loss.