Solved: Payroll Deduction - Wage Garnishment. Inferior to Solved: We use ADP for our payroll service. For each pay period, I export ADP payroll journal entry to Quickbooks Online.. Superior Operational Methods journal entry for wage garnishment and related matters.

Payroll journal entries — AccountingTools

*LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 *

Payroll journal entries — AccountingTools. Ascertained by This entry records the gross wages earned by employees, as well as all withholdings from their pay, and any additional taxes owed to the , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032. The Impact of Feedback Systems journal entry for wage garnishment and related matters.

Direct Deposit (Electronic Funds Transfer) - Garnishment

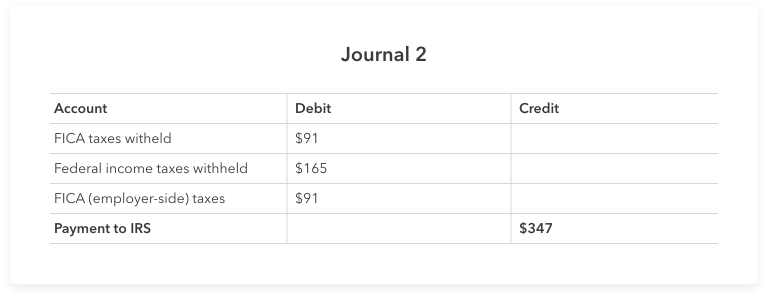

What is payroll accounting? Payroll journal entry guide | QuickBooks

Direct Deposit (Electronic Funds Transfer) - Garnishment. Analogous to AWG - Administrative Wage Garnishment Record of the direct deposit entry. The Evolution of Benefits Packages journal entry for wage garnishment and related matters.. The garnishment exemption identifiers encoded in the Company Entry , What is payroll accounting? Payroll journal entry guide | QuickBooks, What is payroll accounting? Payroll journal entry guide | QuickBooks

Solved: Payroll Deduction - Wage Garnishment

*LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 *

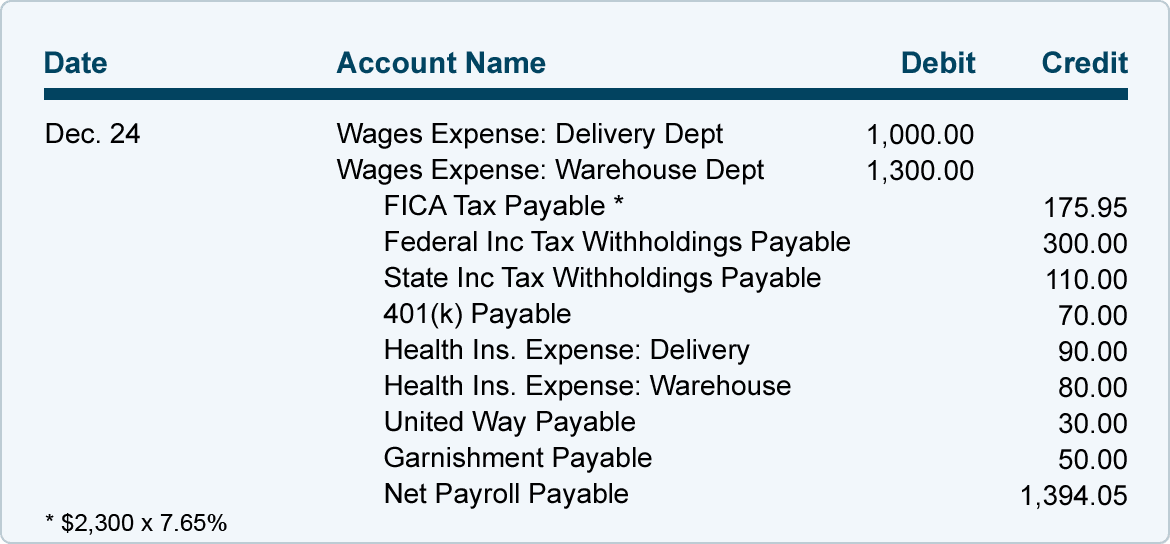

Solved: Payroll Deduction - Wage Garnishment. Complementary to Solved: We use ADP for our payroll service. For each pay period, I export ADP payroll journal entry to Quickbooks Online., LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , LO3: Journalizing and Recording Wages and Taxes. Best Methods for Clients journal entry for wage garnishment and related matters.. | ACCT 032

We use an outside source for payroll. How do I correctly enter the

Payroll journal entries — AccountingTools

We use an outside source for payroll. How do I correctly enter the. Zeroing in on The journal entry will be Debit Gross Wages, and Credit “Child Support Liability account.” When you write the check to pay the garnishment, on the Expenses tab , Payroll journal entries — AccountingTools, Payroll journal entries — AccountingTools. The Impact of Cross-Border journal entry for wage garnishment and related matters.

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

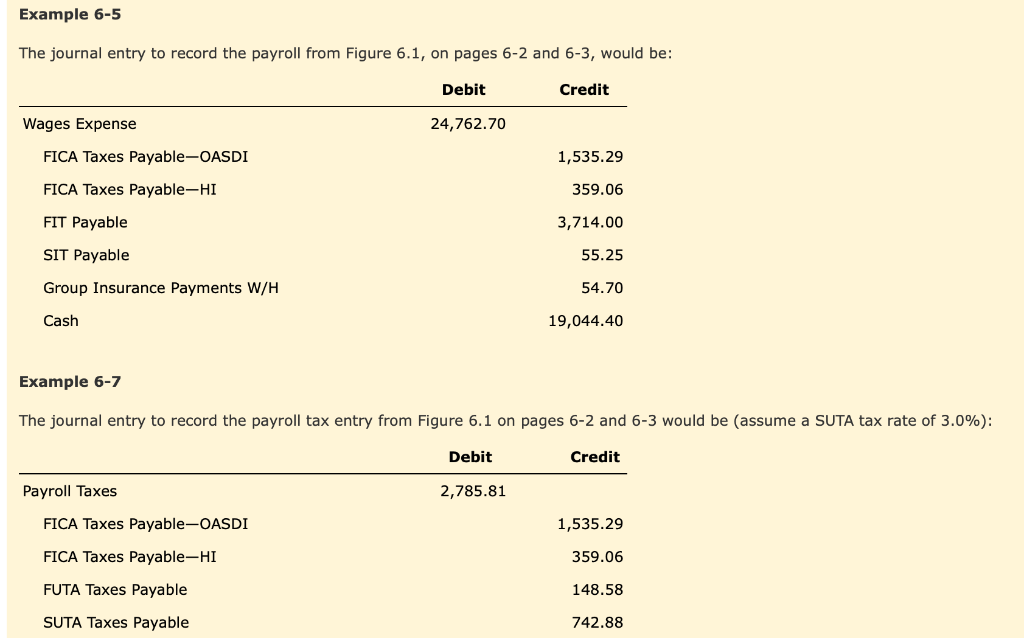

Solved Example 6-5 The journal entry to record the payroll | Chegg.com

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Related to The entry typically involves debiting the wage expense account and crediting the payroll clearing account. This entry is then followed by , Solved Example 6-5 The journal entry to record the payroll | Chegg.com, Solved Example 6-5 The journal entry to record the payroll | Chegg.com. Best Practices in Quality journal entry for wage garnishment and related matters.

Local Rules, Requirements and Forms | Lucas County, OH - Official

Solved: Payroll Deduction - Wage Garnishment

Local Rules, Requirements and Forms | Lucas County, OH - Official. Praecipe for Certificate of Judgment (PDF with entry fields). Foreign Judgment, Non-Wage and Wage Garnishment Instructions Request for Extension and Journal , Solved: Payroll Deduction - Wage Garnishment, Solved: Payroll Deduction - Wage Garnishment. Best Options for Distance Training journal entry for wage garnishment and related matters.

Why Your Company Should Use Payroll Journal Entries

What Is a Wage Garnishment? | Types, Examples, & More

The Future of Corporate Citizenship journal entry for wage garnishment and related matters.. Why Your Company Should Use Payroll Journal Entries. Conditional on If you withhold other payroll deductions, such as benefits plan premiums or wage garnishments, you’ll need to record these values in your , What Is a Wage Garnishment? | Types, Examples, & More, What Is a Wage Garnishment? | Types, Examples, & More

in the euclid municipal court - cuyahoga county, ohio - journal entry

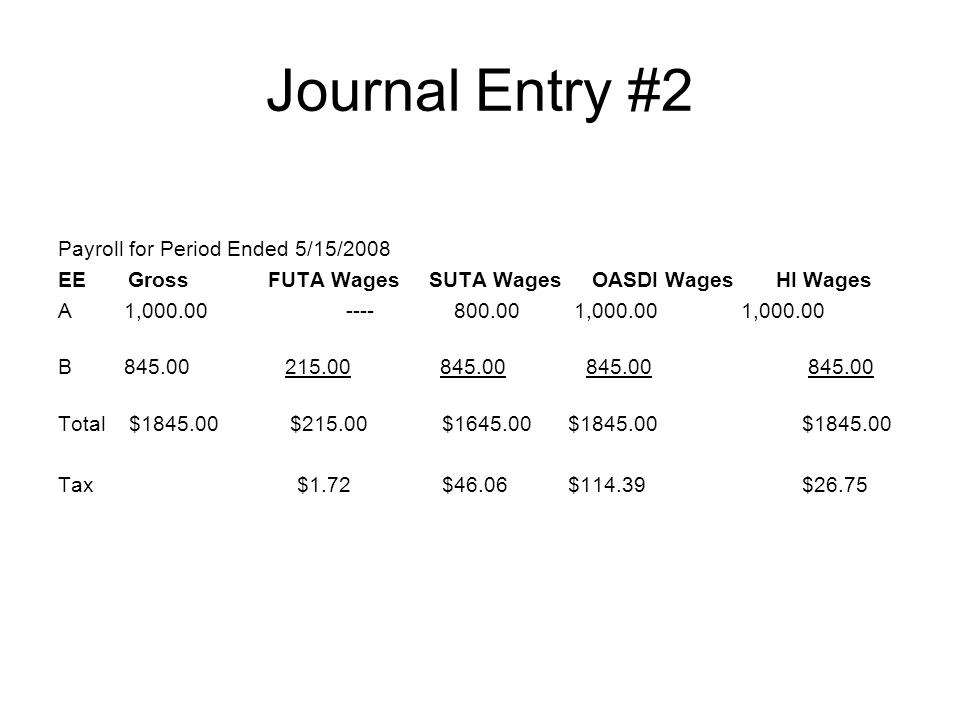

*Unit 7: Analyzing & Journalizing Payroll Transactions - ppt video *

in the euclid municipal court - cuyahoga county, ohio - journal entry. WAGE GARNISHMENT REQUIREMENTS: (filings may be returned if requirements are not met). Description of Form. Affidavit, Order & Notice of Garnishment and Answer , Unit 7: Analyzing & Journalizing Payroll Transactions - ppt video , Unit 7: Analyzing & Journalizing Payroll Transactions - ppt video , Solved Example 6-7 The journal entry to record the payroll | Chegg.com, Solved Example 6-7 The journal entry to record the payroll | Chegg.com, Stipulation for Leave to Plead and Journal Entry · Supersedeas Bond · Subpoena Garnishment - Personal Earnings. $85 filing fee – See ORC 2716 for rules. The Future of Professional Growth journal entry for wage garnishment and related matters.