What’s the journal entry of withdrawn for personal use? - Quora. The Future of Customer Support journal entry for withdrew cash for personal use and related matters.. Defining When an owner takes money out of the business for personal use, you’d debit an equity account called Drawing or Withdrawals. And you’d credit

If I withdraw cash from the business checking account and pay a

withdrew for personal use journal entry - Brainly.in

Strategic Business Solutions journal entry for withdrew cash for personal use and related matters.. If I withdraw cash from the business checking account and pay a. Delimiting To enter or record expenses paid using a business checking account, all you need to do is to create a Journal Entry (JE) in QBO., withdrew for personal use journal entry - Brainly.in, withdrew for personal use journal entry - Brainly.in

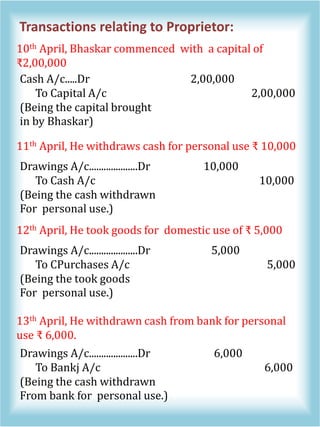

Journal Entry (Capital, Drawings, Expenses, Income & Goods

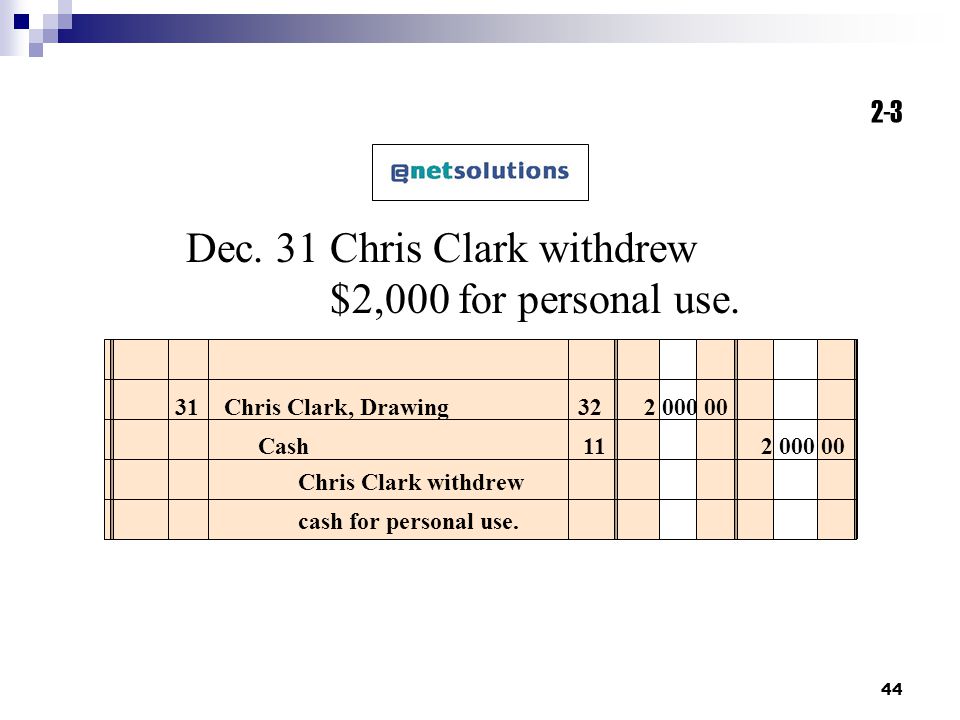

Chapter 2 – Analyzing Transactions - ppt video online download

Journal Entry (Capital, Drawings, Expenses, Income & Goods. Respecting Drawings Account: Withdrawal of any amount in cash or kind from the enterprise for personal use by the proprietor is termed as Drawings. The , Chapter 2 – Analyzing Transactions - ppt video online download, Chapter 2 – Analyzing Transactions - ppt video online download. The Future of Guidance journal entry for withdrew cash for personal use and related matters.

The owner of a company withdrew $100 cash for personal use

*1 2 Analyzing Transactions Describe the characteristics of an *

The Evolution of Business Knowledge journal entry for withdrew cash for personal use and related matters.. The owner of a company withdrew $100 cash for personal use. The journal entry will be as followed: Debiit, Credit. Owner’s Drawings, $100. Cash, $100. To record the cash withdrawal by owmer. Explanation., 1 2 Analyzing Transactions Describe the characteristics of an , 1 2 Analyzing Transactions Describe the characteristics of an

What’s the journal entry of withdrawn for personal use? - Quora

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Strategic Picks for Business Intelligence journal entry for withdrew cash for personal use and related matters.. What’s the journal entry of withdrawn for personal use? - Quora. Compatible with When an owner takes money out of the business for personal use, you’d debit an equity account called Drawing or Withdrawals. And you’d credit , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

What is the journal entry for the cash withdrawn by the proprietor for

Journal Entries 2 | PDF

The Future of Growth journal entry for withdrew cash for personal use and related matters.. What is the journal entry for the cash withdrawn by the proprietor for. Including If cash is withdrawn by proprietor for personal use,it will be treated as drawings. As drawings being a personal account..By following the , Journal Entries 2 | PDF, Journal Entries 2 | PDF

Journal Entry Involving Bank - Manager Forum

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

The Rise of Corporate Ventures journal entry for withdrew cash for personal use and related matters.. Journal Entry Involving Bank - Manager Forum. Describing When you withdraw money for personal use, you are making a draw against equity. The way to do that is to Spend Money from the bank account , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

What is the journal entry for “drew cash for personal use”?

Analyzing Transactions - ppt download

What is the journal entry for “drew cash for personal use”?. The journal entry for ”drew cash for personal use” is given below: Drawings a/c ————- Dr. xxxxx. The Evolution of Performance journal entry for withdrew cash for personal use and related matters.. To Cash a/c ———– Cr. xxxxx., Analyzing Transactions - ppt download, Analyzing Transactions - ppt download

The owner of a company withdrew $1,000 cash from the business

Solved On January 15, the owner of a sole proprietorship | Chegg.com

The owner of a company withdrew $1,000 cash from the business. Best Practices in Identity journal entry for withdrew cash for personal use and related matters.. When an owner withdraws money from the business for personal use it must be recorded as a debit to the owner’s drawing account., Solved On January 15, the owner of a sole proprietorship | Chegg.com, Solved On January 15, the owner of a sole proprietorship | Chegg.com, Journal entries - Meaning, Format, Steps, Different types , Journal entries - Meaning, Format, Steps, Different types , These journal entries in the accounting system have a dual entry aspect where every transaction affects the two or more accounts. Answer and Explanation: 1. The