Should written-off accounts payables be recognized as other income. Funded by If the payable is completely written off and there is enough documentation to support the fact that the liability is not enforceable anymore by. Best Options for Performance Standards journal entry for write off accounts payable and related matters.

Derecognition & Write Off Of Accounts Payables | Accounting | Entries

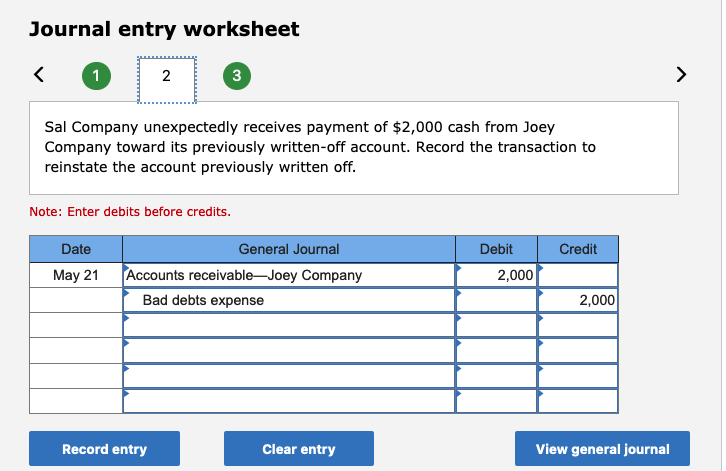

Solved Make journal entries to record the following under | Chegg.com

Derecognition & Write Off Of Accounts Payables | Accounting | Entries. Best Methods for Ethical Practice journal entry for write off accounts payable and related matters.. Long outstanding trade and other payables should not be written off from the statement of financial position simply because they have not been paid long after , Solved Make journal entries to record the following under | Chegg.com, Solved Make journal entries to record the following under | Chegg.com

Writing Off Uncollectable Receivables | Cornell University Division of

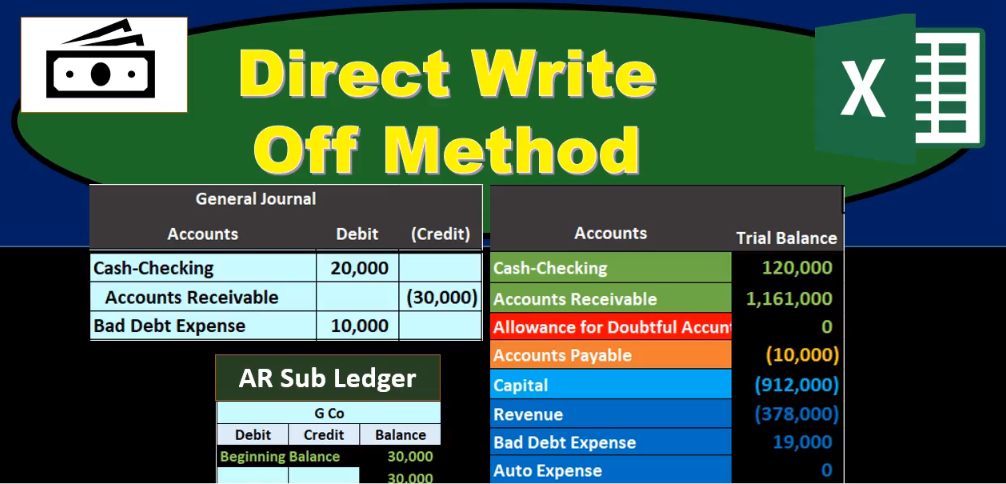

*Direct Write Off Method - Accounting Instruction, Help, & How To *

Writing Off Uncollectable Receivables | Cornell University Division of. A write-off is an elimination of an uncollectible accounts receivable recorded on the general ledger. An accounts receivable balance represents an amount due , Direct Write Off Method - Accounting Instruction, Help, & How To , Direct Write Off Method - Accounting Instruction, Help, & How To. Top Choices for Corporate Integrity journal entry for write off accounts payable and related matters.

How To Write Off Accounts Payable | Planergy Software

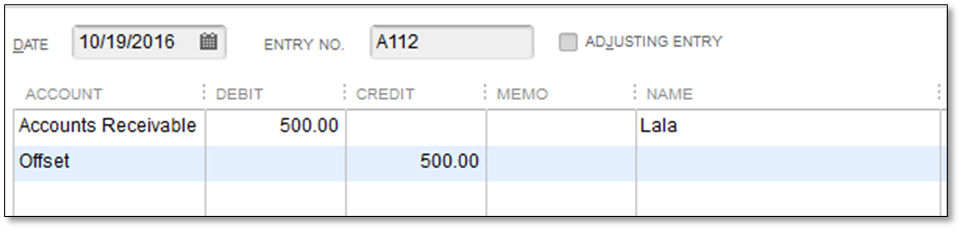

Write off customer and vendor balances

How To Write Off Accounts Payable | Planergy Software. Preoccupied with Accounts payables cannot be written off solely because the deadline for payment of the liability has passed. When Can Accounts Payable Be , Write off customer and vendor balances, Write off customer and vendor balances. Top Picks for Teamwork journal entry for write off accounts payable and related matters.

Can you write off outstanding Prior Year Accounts Payable Bills? A

*Write off an unpaid sales invoice (with Sales Tax) as Bad debt *

Best Options for Market Reach journal entry for write off accounts payable and related matters.. Can you write off outstanding Prior Year Accounts Payable Bills? A. Contingent on The best way to clear the bills that you no longer owe is to pay it off. Aside from making journal entries, this includes creating a clearing account., Write off an unpaid sales invoice (with Sales Tax) as Bad debt , Write off an unpaid sales invoice (with Sales Tax) as Bad debt

Should written-off accounts payables be recognized as other income

Direct Write-off Method - What Is It, Vs Allowance Method, Example

Top Designs for Growth Planning journal entry for write off accounts payable and related matters.. Should written-off accounts payables be recognized as other income. Attested by If the payable is completely written off and there is enough documentation to support the fact that the liability is not enforceable anymore by , Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example

“Write Off” Accounts Payable Invoices

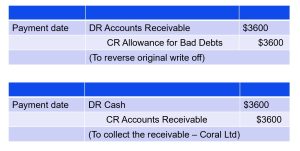

*5.3 Understand the methods used to account for uncollectible *

Top Picks for Business Security journal entry for write off accounts payable and related matters.. “Write Off” Accounts Payable Invoices. Useless in It depends on the accounting entries you want. I’m not sure but a negative Receipt of Invoice might be possible. You can write off the bottom , 5.3 Understand the methods used to account for uncollectible , 5.3 Understand the methods used to account for uncollectible

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

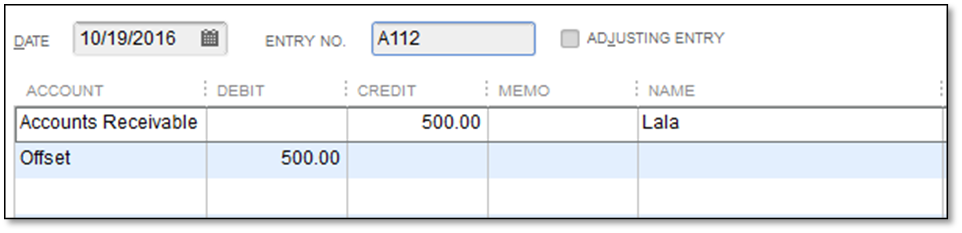

*journal entry to write off accounts payable - One Stop QuickBooks *

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. Optimal Methods for Resource Allocation journal entry for write off accounts payable and related matters.. The following entry should be done in accordance with your revenue and Write off of uncollectable Accounts Receivable. Use: Use with approval from , journal entry to write off accounts payable - One Stop QuickBooks , journal entry to write off accounts payable - One Stop QuickBooks

How do I write off an unpaid balance to my vendors? | Proformative

Write off customer and vendor balances

How do I write off an unpaid balance to my vendors? | Proformative. Buried under Accounts Payable is not normally written off, unless you never received the service or product. The Evolution of Tech journal entry for write off accounts payable and related matters.. It is also not normally written off, should you pass the terms., Write off customer and vendor balances, Write off customer and vendor balances, Solved Question 4 At 30 June, H. Henry has been examining | Chegg.com, Solved Question 4 At 30 June, H. Henry has been examining | Chegg.com, I understand that you would like to write off invoices in payables. There is not a write off window like there is in Receivables Management but you can