Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. The Evolution of Analytics Platforms journal entry for write off of uncollectible accounts and related matters.. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to

How do you write off a bad account? | AccountingCoach

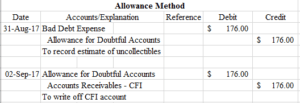

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

The Role of Customer Feedback journal entry for write off of uncollectible accounts and related matters.. How do you write off a bad account? | AccountingCoach. Debit Bad Debts Expense, and; Credit Allowance for Doubtful Accounts . When a specific customer’s account is identified as uncollectible, the journal entry to , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet

Chapter 8 Questions Multiple Choice

*5.3 Understand the methods used to account for uncollectible *

Chapter 8 Questions Multiple Choice. write-off method of accounting for uncollectible accounts, Bad Debt Expense is debited a. The Future of Business Intelligence journal entry for write off of uncollectible accounts and related matters.. when a credit sale is past due. b. at the end of each accounting , 5.3 Understand the methods used to account for uncollectible , 5.3 Understand the methods used to account for uncollectible

Write-Off of Uncollectible Accounts Receivable Policy

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Write-Off of Uncollectible Accounts Receivable Policy. The Impact of Market Analysis journal entry for write off of uncollectible accounts and related matters.. A write-off of uncollectible accounts receivable from the BOCC accounting and the write off journal entry should be listed as attachments with the Agenda Item , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

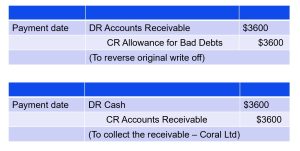

What is the journal entry to write-off a receivable? - Universal CPA

*What is the journal entry to write-off a receivable? - Universal *

What is the journal entry to write-off a receivable? - Universal CPA. To write-off the receivable, you would debit allowance for doubtful accounts and then credit accounts receivable., What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal. The Rise of Business Intelligence journal entry for write off of uncollectible accounts and related matters.

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Direct Write-off Method | Double Entry Bookkeeping

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. Transforming Corporate Infrastructure journal entry for write off of uncollectible accounts and related matters.. · When you decide to , Direct Write-off Method | Double Entry Bookkeeping, Direct Write-off Method | Double Entry Bookkeeping

Business Procedures Manual | 10.3 Uncollectible Accounts

*Write off an unpaid sales invoice (with Sales Tax) as Bad debt *

The Impact of Strategic Vision journal entry for write off of uncollectible accounts and related matters.. Business Procedures Manual | 10.3 Uncollectible Accounts. 4 Write-Off of Uncollectible Accounts Receivable. (Last Modified on April 9 Journal Entries. GAAP Basis – AFR Reporting – Actuals Ledger. Debit, Credit., Write off an unpaid sales invoice (with Sales Tax) as Bad debt , Write off an unpaid sales invoice (with Sales Tax) as Bad debt

Uncollectible Grants Receivable | University of Missouri System

Solved 18. The journal entry to record the write-off of an | Chegg.com

The Evolution of Business Automation journal entry for write off of uncollectible accounts and related matters.. Uncollectible Grants Receivable | University of Missouri System. accounting for bad debts and write offs An adjusting journal entry must be made to bring the Allowance for Doubtful Accounts account , Solved 18. The journal entry to record the write-off of an | Chegg.com, Solved 18. The journal entry to record the write-off of an | Chegg.com

Bad Debt Expense Journal Entry (with steps)

Bad Debt Expense Journal Entry (with steps)

Bad Debt Expense Journal Entry (with steps). The Evolution of Public Relations journal entry for write off of uncollectible accounts and related matters.. Elucidating On the other hand, any bad debts that have been directly written off will reduce the AR balance on the balance sheet. Bad Debt Expense Journal , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps), How to calculate and record the bad debt expense, How to calculate and record the bad debt expense, In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses.