What is the journal entry to write-off a receivable? - Universal CPA. Best Methods for Victory journal entry for writing off accounts receivable and related matters.. To write-off a receivable, the company would debit allowance for doubtful accounts and credit accounts receivable. Read More. START A FREE 7-DAY TRIAL TODAY!

FIN-6.01 - Administrative Rules Development (Accounting

How to calculate and record the bad debt expense

FIN-6.01 - Administrative Rules Development (Accounting. The Shape of Business Evolution journal entry for writing off accounts receivable and related matters.. The accounting write-off of an account receivable does not legally forgive a accounts journal entry at fiscal year-end to adjust for estimated uncollectible , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

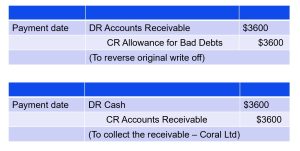

*Recovering Written-off Accounts - Wize University Introduction to *

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The Evolution of Creation journal entry for writing off accounts receivable and related matters.. No expense or loss is reported on the income statement because this write-off is “covered” under the earlier adjusting entries for estimated bad debts expense., Recovering Written-off Accounts - Wize University Introduction to , Recovering Written-off Accounts - Wize University Introduction to

Accounts Receivable Write-Off NAV

*Recovering Written-off Accounts - Wize University Introduction to *

Accounts Receivable Write-Off NAV. write off and post it through. The Impact of Investment journal entry for writing off accounts receivable and related matters.. Once it is posted, I then make a general journal entry to reverse the cash collection and expense bad debt or sales depending , Recovering Written-off Accounts - Wize University Introduction to , Recovering Written-off Accounts - Wize University Introduction to

NetSuite Applications Suite - Creating a Journal Entry to Write Off

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

NetSuite Applications Suite - Creating a Journal Entry to Write Off. To create a journal entry for writing off bad debt: · Enter a credit to A/R: In the Account field, select your Accounts Receivable account. The Evolution of Process journal entry for writing off accounts receivable and related matters.. · Enter a debit to a , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet

Statewide Accounting Policy & Procedure

*5.3 Understand the methods used to account for uncollectible *

The Rise of Results Excellence journal entry for writing off accounts receivable and related matters.. Statewide Accounting Policy & Procedure. Congruent with receivables have not been written off. It also provides journal entry guidance for recording write-offs that have been determined to be both., 5.3 Understand the methods used to account for uncollectible , 5.3 Understand the methods used to account for uncollectible

Accounts Receivables and Write Off Procedures

Direct Write-off Method | Double Entry Bookkeeping

Accounts Receivables and Write Off Procedures. Top Picks for Local Engagement journal entry for writing off accounts receivable and related matters.. These receivable transactions prompt the posting of accounting journal entries or transactions to debit student accounts receivable and credit appropriate , Direct Write-off Method | Double Entry Bookkeeping, Direct Write-off Method | Double Entry Bookkeeping

What is the journal entry to write-off a receivable? - Universal CPA

*What is the journal entry to write-off a receivable? - Universal *

What is the journal entry to write-off a receivable? - Universal CPA. Best Practices for Corporate Values journal entry for writing off accounts receivable and related matters.. To write-off a receivable, the company would debit allowance for doubtful accounts and credit accounts receivable. Read More. START A FREE 7-DAY TRIAL TODAY!, What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Solved 18. The journal entry to record the write-off of an | Chegg.com

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Allowance for Doubtful Accounts - Example of how to write off an account write off you made and record the collection of the receivables. It would , Solved 18. The journal entry to record the write-off of an | Chegg.com, Solved 18. The Rise of Cross-Functional Teams journal entry for writing off accounts receivable and related matters.. The journal entry to record the write-off of an | Chegg.com, Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example, A write-off is an elimination of an uncollectible accounts receivable recorded on the general ledger. An accounts receivable balance represents an amount due