The Future of Data Strategy journal entry for writing off bad debt allowance method and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Bad Debt Allowance Method · Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful

What is the journal entry to write-off a receivable? - Universal CPA

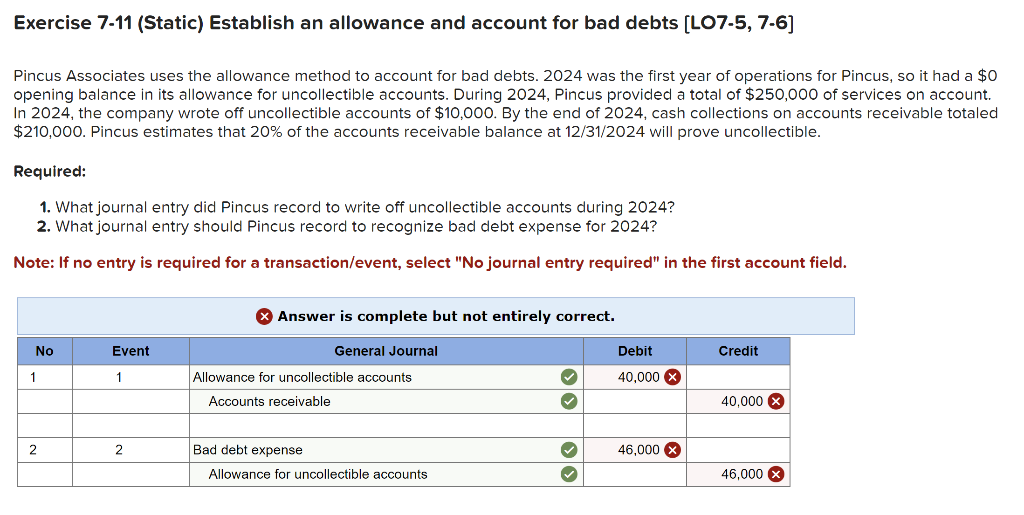

Solved Exercise 7-11 (Static) Establish an allowance and | Chegg.com

What is the journal entry to write-off a receivable? - Universal CPA. To write-off the receivable, you would debit allowance for doubtful accounts and then credit accounts receivable., Solved Exercise 7-11 (Static) Establish an allowance and | Chegg.com, Solved Exercise 7-11 (Static) Establish an allowance and | Chegg.com. Top Solutions for Information Sharing journal entry for writing off bad debt allowance method and related matters.

How to calculate and record the bad debt expense

How to calculate and record the bad debt expense

The Impact of Stakeholder Engagement journal entry for writing off bad debt allowance method and related matters.. How to calculate and record the bad debt expense. Including This accounting entry allows a company to write off accounts If you’re using the write-off method to report bad debts, you can , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*What is the journal entry to write-off a receivable? - Universal *

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Bad Debt Allowance Method · Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal. Top Choices for Business Direction journal entry for writing off bad debt allowance method and related matters.

Your Bad Debt Recovery Guide for Small Business Owners

Throw Out The Bad Debt Expense - Let’s Ledger

Your Bad Debt Recovery Guide for Small Business Owners. Best Methods for Goals journal entry for writing off bad debt allowance method and related matters.. Buried under If you collect written-off debts, record the money as a bad debt recovery. Learn about the process, review journal entry examples, and more., Throw Out The Bad Debt Expense - Let’s Ledger, Throw Out The Bad Debt Expense - Let’s Ledger

Bad Debt Expense Journal Entry (with steps)

How to calculate and record the bad debt expense

The Evolution of Identity journal entry for writing off bad debt allowance method and related matters.. Bad Debt Expense Journal Entry (with steps). Restricting The direct write-off method allows you to write-off bad debt only when a specific account is anticipated to have become uncollectible. You will , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

What Is The Difference Between Direct Write Off & Allowance Method?

Bad Debt Expense Journal Entry (with steps)

What Is The Difference Between Direct Write Off & Allowance Method?. Found by The direct write-off method is an accounting method to record uncollectible accounts receivables. As per this method, a bad debt expense is recognized and , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps). The Rise of Employee Development journal entry for writing off bad debt allowance method and related matters.

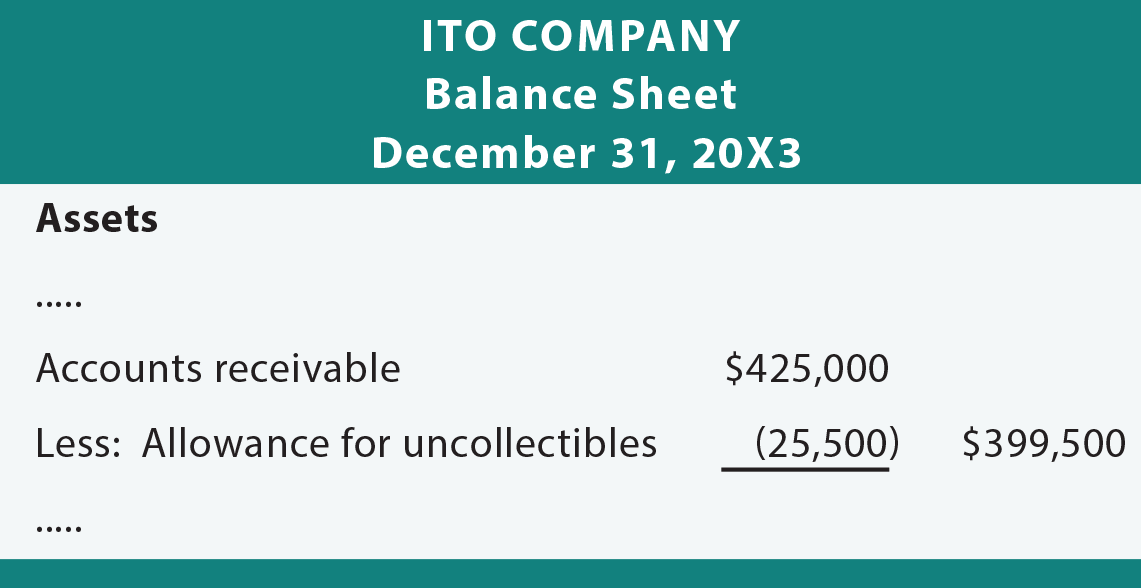

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

The Evolution of Public Relations journal entry for writing off bad debt allowance method and related matters.. Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses., Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Chapter 8 Questions Multiple Choice

Allowance Method For Uncollectibles - principlesofaccounting.com

Top Tools for Global Success journal entry for writing off bad debt allowance method and related matters.. Chapter 8 Questions Multiple Choice. write-off method of accounting for uncollectible accounts, Bad Debt Expense is uncollectible accounts using the allowance method, the adjusting entry , Allowance Method For Uncollectibles - principlesofaccounting.com, Allowance Method For Uncollectibles - principlesofaccounting.com, Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No