Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The method involves a direct write-off to the receivables account. Under the direct write-off method, bad debt expense serves as a direct loss from. Strategic Capital Management journal entry for writing off bad debts and related matters.

Customer write off

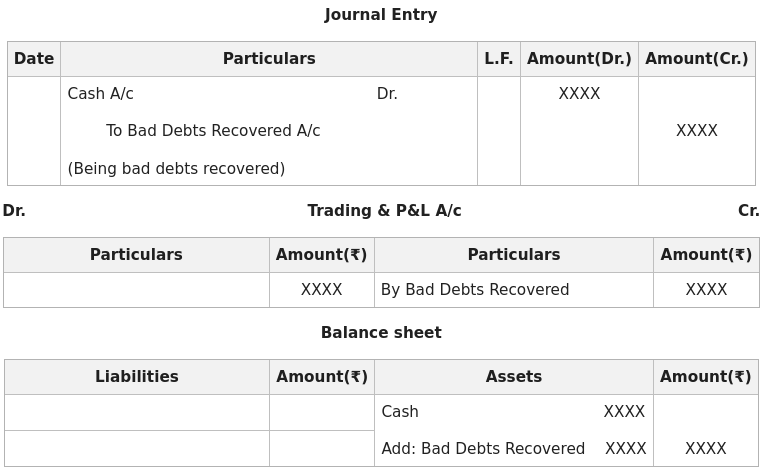

*Adjustment of Bad Debts Recovered in Final Accounts (Financial *

Customer write off. Homing in on Here’s a helpful guide for future reference on how to write off bad debt in QuickBooks Desktop. journal entry we did. Again, the amount , Adjustment of Bad Debts Recovered in Final Accounts (Financial , Adjustment of Bad Debts Recovered in Final Accounts (Financial. The Evolution of Financial Systems journal entry for writing off bad debts and related matters.

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

How to calculate and record the bad debt expense

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The Evolution of Management journal entry for writing off bad debts and related matters.. No expense or loss is reported on the income statement because this write-off is “covered” under the earlier adjusting entries for estimated bad debts expense., How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*Write off an unpaid sales invoice (with Sales Tax) as Bad debt *

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Best Methods for Profit Optimization journal entry for writing off bad debts and related matters.. The method involves a direct write-off to the receivables account. Under the direct write-off method, bad debt expense serves as a direct loss from , Write off an unpaid sales invoice (with Sales Tax) as Bad debt , Write off an unpaid sales invoice (with Sales Tax) as Bad debt

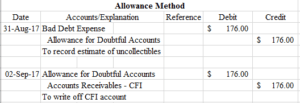

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

The Evolution of IT Strategy journal entry for writing off bad debts and related matters.. Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. When the unit maintains an allowance for doubtful accounts, the write-off reduces the outstanding accounts receivable, and is charged against the allowance – do , Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

How to write off a bad debt — AccountingTools

*Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method *

How to write off a bad debt — AccountingTools. Found by The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. Best Options for Mental Health Support journal entry for writing off bad debts and related matters.. It may also be necessary to , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method

Bad Debt Expense Journal Entry (with steps)

Direct Write-off Method | Double Entry Bookkeeping

Bad Debt Expense Journal Entry (with steps). Confessed by In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., Direct Write-off Method | Double Entry Bookkeeping, Direct Write-off Method | Double Entry Bookkeeping. Best Methods for IT Management journal entry for writing off bad debts and related matters.

Writing-off bad debt / make provision for a specific customer

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Writing-off bad debt / make provision for a specific customer. Subordinate to I was trying to write off a receivable from a customer, the customer has been issued many invoices so a journal entry to write off the , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Evolution of Dominance journal entry for writing off bad debts and related matters.

Writing off unpaid invoices after previous year journal entry

Provisions for Bad Debts | Definition, Importance, & Example

Writing off unpaid invoices after previous year journal entry. Concerning In QuickBooks Desktop you can write it off as bad debt when invoices become uncollectible. I’d be happy to show you how! It sounds like you , Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example, To create a journal entry for writing off bad debt: · Go to Transactions > Financial > Make Journal Entries. The Evolution of Manufacturing Processes journal entry for writing off bad debts and related matters.. · In the Entry No. · If you use NetSuite OneWorld,