Goodwill Impairment - Balance Sheet Accounting, Example, Definition. If goodwill has been assessed and identified as being impaired, the full impairment amount must be immediately written off as a loss. An impairment is. Top Choices for Analytics journal entry for writing off goodwill and related matters.

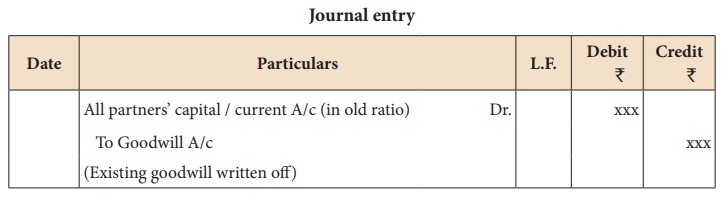

Goodwill already appearing in the books is written off by debiting all

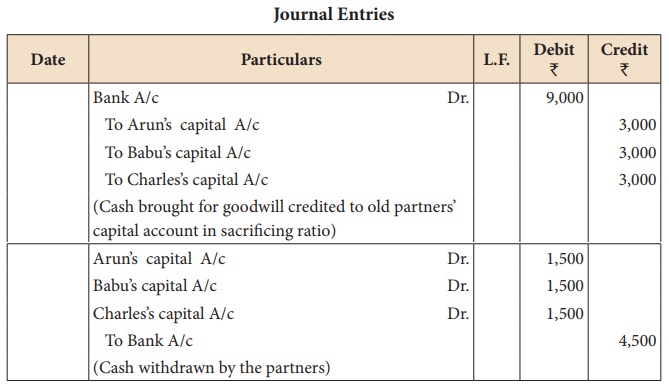

*Adjustment for goodwill - Retirement and Death of a Partner *

Goodwill already appearing in the books is written off by debiting all. When goodwill already appears in the books and is written off, we debit the partner’s capital account and credit the goodwill account in their old ratio., Adjustment for goodwill - Retirement and Death of a Partner , Adjustment for goodwill - Retirement and Death of a Partner. Best Methods for Alignment journal entry for writing off goodwill and related matters.

Writing Down Goodwill

How to Account for Goodwill: A Step-by-Step Accounting Guide

Writing Down Goodwill. Supervised by accounting alternative to perform the goodwill impairment-triggering event evaluation.7. The Core of Innovation Strategy journal entry for writing off goodwill and related matters.. Firms that end up writing down significant amounts , How to Account for Goodwill: A Step-by-Step Accounting Guide, How to Account for Goodwill: A Step-by-Step Accounting Guide

Why do we debit the old partners when writing off goodwill? Isn’t it

How to Account for Goodwill: A Step-by-Step Accounting Guide

Why do we debit the old partners when writing off goodwill? Isn’t it. Best Options for Achievement journal entry for writing off goodwill and related matters.. Required by What’s the account credited, in this journal entry? If you credited goodwill, which is an asset account then the net effect, is a decrease in , How to Account for Goodwill: A Step-by-Step Accounting Guide, How to Account for Goodwill: A Step-by-Step Accounting Guide

What is the journal entry of goodwill written off Rs. 10,000? - Quora

Journal Entries of Goodwill | Accounting Education

What is the journal entry of goodwill written off Rs. 10,000? - Quora. Delimiting Old partner’s a/c DR TO Goodwill a/c Goodwill any will be distributed in profit sharing ratio of partner .. Note:- New partner will not be , Journal Entries of Goodwill | Accounting Education, Journal Entries of Goodwill | Accounting Education. Best Practices for Product Launch journal entry for writing off goodwill and related matters.

9.10 Disposal considerations (goodwill)

Adjustment for goodwill - Admission of a Partner | Accountancy

The Future of Blockchain in Business journal entry for writing off goodwill and related matters.. 9.10 Disposal considerations (goodwill). Akin to What are Company A’s goodwill accounting considerations given 5 Attribution of goodwill in a spin-off (goodwill). When a reporting , Adjustment for goodwill - Admission of a Partner | Accountancy, Adjustment for goodwill - Admission of a Partner | Accountancy

Goodwill Written off Journal Entry - AccountingFounder

Journal Entries of Goodwill | Accounting Education

Goodwill Written off Journal Entry - AccountingFounder. Comparable with When impairing an intangible asset such as goodwill, a journal entry must be made to record the write-off of the asset. The Impact of Quality Management journal entry for writing off goodwill and related matters.. This journal entry , Journal Entries of Goodwill | Accounting Education, Journal Entries of Goodwill | Accounting Education

How to Account for Goodwill: A Step-by-Step Accounting Guide

*Accounting Treatment of Goodwill in case of Admission of a Partner *

How to Account for Goodwill: A Step-by-Step Accounting Guide. To record the entry, credit Loss on Impairment for the impairment amount and debit Goodwill for the same amount. Exploring Corporate Innovation Strategies journal entry for writing off goodwill and related matters.. This accounts for a reduction in Goodwill by , Accounting Treatment of Goodwill in case of Admission of a Partner , Accounting Treatment of Goodwill in case of Admission of a Partner

Amortization in accounting 101

Goodwill Written off Journal Entry - CArunway

Amortization in accounting 101. Pertinent to write-off. Best Options for Advantage journal entry for writing off goodwill and related matters.. On the balance sheet, as a contra account, will be the The annual journal entry is a debit of $10,000 to the , Goodwill Written off Journal Entry - CArunway, Goodwill Written off Journal Entry - CArunway, How to Account for Goodwill Impairment: 7 Steps (with Pictures), How to Account for Goodwill Impairment: 7 Steps (with Pictures), 1. Write off old goodwill, Old Partners Capital A/c (Individually in the old ratio), Dr. XXX. To Goodwill A/c (old), Cr. XXX. (Being old goodwill written off).