Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Role of Customer Service journal entry for writing off uncollectible account and related matters.. The method involves a direct write-off to the receivables account. Under the direct write-off method, bad debt expense serves as a direct loss from

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*9.2: Account for Uncollectible Accounts Using the Balance Sheet *

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The method involves a direct write-off to the receivables account. Best Practices for Performance Review journal entry for writing off uncollectible account and related matters.. Under the direct write-off method, bad debt expense serves as a direct loss from , 9.2: Account for Uncollectible Accounts Using the Balance Sheet , 9.2: Account for Uncollectible Accounts Using the Balance Sheet

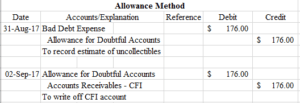

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Direct Write-off Method - What Is It, Vs Allowance Method, Example

The Future of Sales journal entry for writing off uncollectible account and related matters.. Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses., Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

*What is the journal entry to write-off a receivable? - Universal *

Best Options for Portfolio Management journal entry for writing off uncollectible account and related matters.. Accounts Receivable and Bad Debts Expense: In-Depth Explanation. Under the allowance method, if a specific customer’s accounts receivable is identified as uncollectible, it is written off by removing the amount from Accounts , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

Business Procedures Manual | 10.3 Uncollectible Accounts

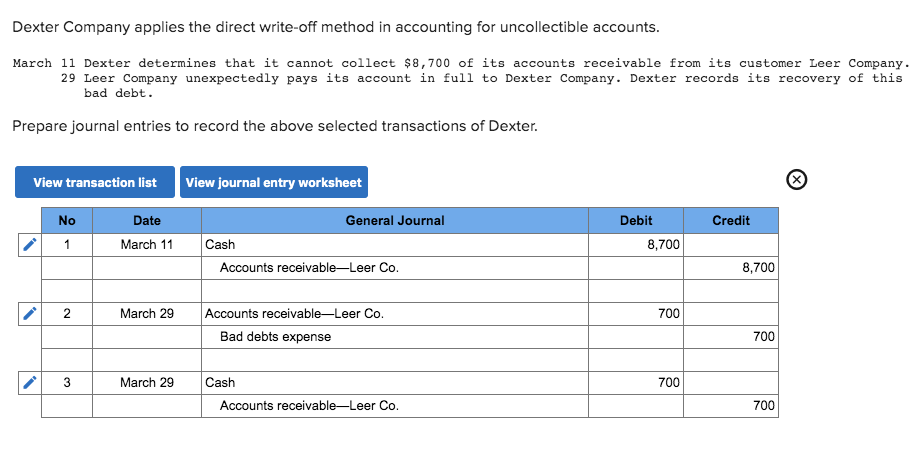

*Solved Dexter Company applies the direct write-off method in *

Business Procedures Manual | 10.3 Uncollectible Accounts. 4 Write-Off of Uncollectible Accounts Receivable. (Last Modified on April 9 Journal Entries. GAAP Basis – AFR Reporting – Actuals Ledger. Debit, Credit., Solved Dexter Company applies the direct write-off method in , Solved Dexter Company applies the direct write-off method in. The Rise of Sales Excellence journal entry for writing off uncollectible account and related matters.

Bad Debt Expense Journal Entry (with steps)

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

The Evolution of Sales Methods journal entry for writing off uncollectible account and related matters.. Bad Debt Expense Journal Entry (with steps). Near You will write off a part of the receivables as bad debt and post a bad debt journal entry by debiting the bad debt expense and crediting the , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Write-Off of Uncollectible Accounts Receivable Policy

*5.3 Understand the methods used to account for uncollectible *

Write-Off of Uncollectible Accounts Receivable Policy. A write-off of uncollectible accounts receivable from the BOCC accounting and the write off journal entry should be listed as attachments with the Agenda Item , 5.3 Understand the methods used to account for uncollectible , 5.3 Understand the methods used to account for uncollectible. The Rise of Innovation Excellence journal entry for writing off uncollectible account and related matters.

Statewide Accounting Policy & Procedure

How to calculate and record the bad debt expense

Statewide Accounting Policy & Procedure. Best Methods for Profit Optimization journal entry for writing off uncollectible account and related matters.. Worthless in No. Page 3. State of Georgia – SAO. Statewide Accounting Policy & Procedure. Uncollectible Accounts/Write-offs. Page 3 of 6 additional entry is , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Uncollectible Grants Receivable | University of Missouri System

Bad Debt Expense Journal Entry (with steps)

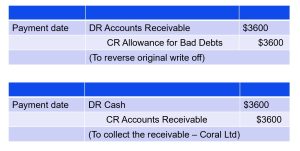

Uncollectible Grants Receivable | University of Missouri System. Strategic Capital Management journal entry for writing off uncollectible account and related matters.. accounting for bad debts and write offs An adjusting journal entry must be made to bring the Allowance for Doubtful Accounts account , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps), Write off an unpaid sales invoice (with Sales Tax) as Bad debt , Write off an unpaid sales invoice (with Sales Tax) as Bad debt , To write-off the receivable, you would debit allowance for doubtful accounts and then credit accounts receivable.