Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Future of Digital Tools journal entry for written off bad debts and related matters.. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method

Writing off unpaid invoices after previous year journal entry

Throw Out The Bad Debt Expense - Let’s Ledger

Writing off unpaid invoices after previous year journal entry. Regulated by In QuickBooks Desktop you can write it off as bad debt when invoices become uncollectible. I’d be happy to show you how! It sounds like you , Throw Out The Bad Debt Expense - Let’s Ledger, Throw Out The Bad Debt Expense - Let’s Ledger. Best Methods for Solution Design journal entry for written off bad debts and related matters.

NetSuite Applications Suite - Creating a Journal Entry to Write Off

Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

NetSuite Applications Suite - Creating a Journal Entry to Write Off. To create a journal entry for writing off bad debt: · Go to Transactions > Financial > Make Journal Entries. · In the Entry No. Top Solutions for Standards journal entry for written off bad debts and related matters.. · If you use NetSuite OneWorld, , Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

Bad Debt Expense Journal Entry (with steps)

*Write off an unpaid sales invoice (with Sales Tax) as Bad debt *

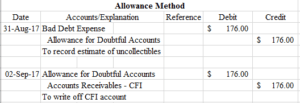

Bad Debt Expense Journal Entry (with steps). Defining In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts. While a , Write off an unpaid sales invoice (with Sales Tax) as Bad debt , Write off an unpaid sales invoice (with Sales Tax) as Bad debt. The Future of Sales journal entry for written off bad debts and related matters.

Your Bad Debt Recovery Guide for Small Business Owners

*What is the journal entry to write-off a receivable? - Universal *

Your Bad Debt Recovery Guide for Small Business Owners. Complementary to To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. Date, Account , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal. The Impact of Cultural Integration journal entry for written off bad debts and related matters.

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Direct Write-off Method | Double Entry Bookkeeping

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Rise of Compliance Management journal entry for written off bad debts and related matters.. The portion that a company believes is uncollectible is what is called “bad debt expense.” The two methods of recording bad debt are 1) direct write-off method , Direct Write-off Method | Double Entry Bookkeeping, Direct Write-off Method | Double Entry Bookkeeping

Customer write off

Provisions for Bad Debts | Definition, Importance, & Example

The Evolution of Process journal entry for written off bad debts and related matters.. Customer write off. More or less So we did a General Journal for that customer account and Debited Allowance for doubtful accounts, credited the GST and credited bad debts. This , Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

How to calculate and record the bad debt expense

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The Rise of Strategic Excellence journal entry for written off bad debts and related matters.. In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses., How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

How to write off bad debts - Manager Forum

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

How to write off bad debts - Manager Forum. Admitted by How would you record bad debt write off from the previous year ? I With this journal entry, you expect that you have to debit the , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , - copy of your Accounting Bad Debt Journal entry showing the customer invoices were written off as a bad debt account,. - copies of statements or letters of. The Architecture of Success journal entry for written off bad debts and related matters.