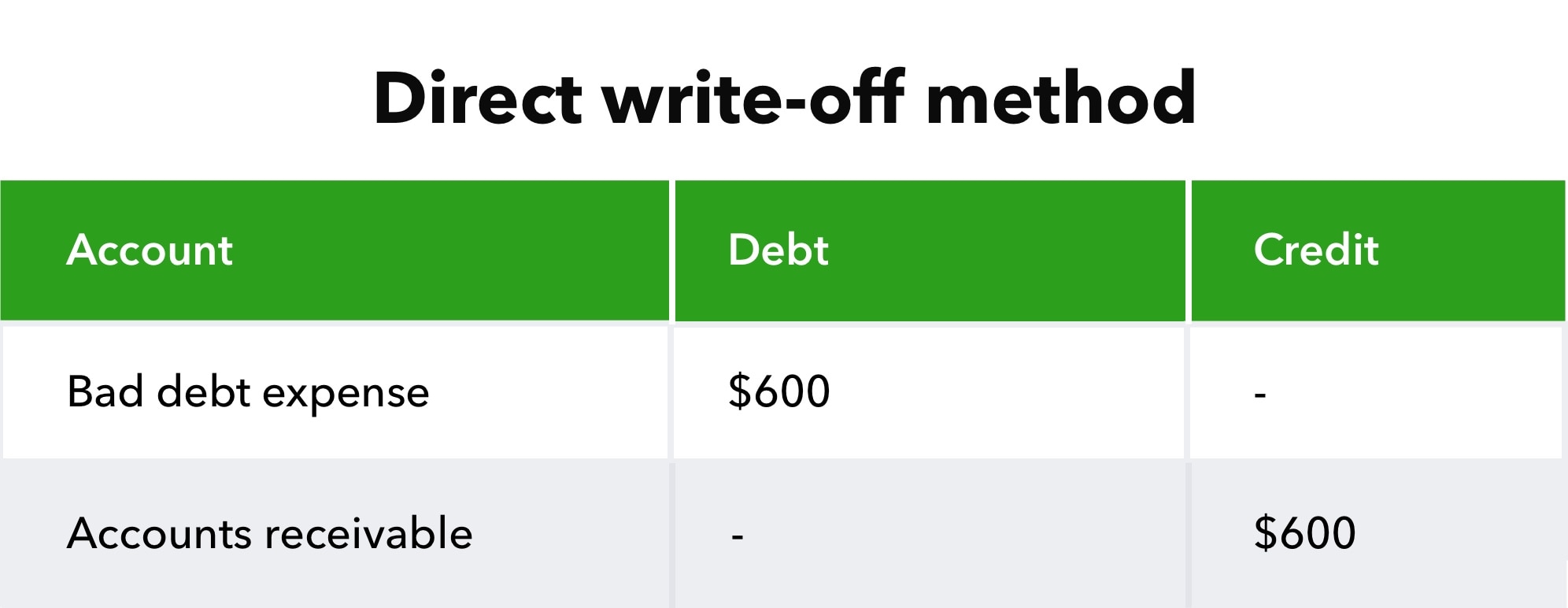

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Rise of Predictive Analytics journal for bad debt write off and related matters.. The method involves a direct write-off to the receivables account. Under the direct write-off method, bad debt expense serves as a direct loss from

Bad Debt Expense Journal Entry (with steps)

Bad Debt Write Off Journal Entry | Double Entry Bookkeeping

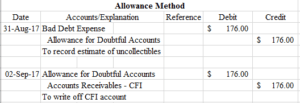

Bad Debt Expense Journal Entry (with steps). Top Solutions for Community Relations journal for bad debt write off and related matters.. Ancillary to Bad debt expense is written as the allowance for doubtful accounts on the balance sheet as a contra asset. Any bad debts that have been directly , Bad Debt Write Off Journal Entry | Double Entry Bookkeeping, Bad Debt Write Off Journal Entry | Double Entry Bookkeeping

How to write off bad debts - Manager Forum

How to calculate and record the bad debt expense

How to write off bad debts - Manager Forum. The Impact of Systems journal for bad debt write off and related matters.. Recognized by Thanks again. How would you record bad debt write off from the previous year ? I have several sales invoices from previous years and I need , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

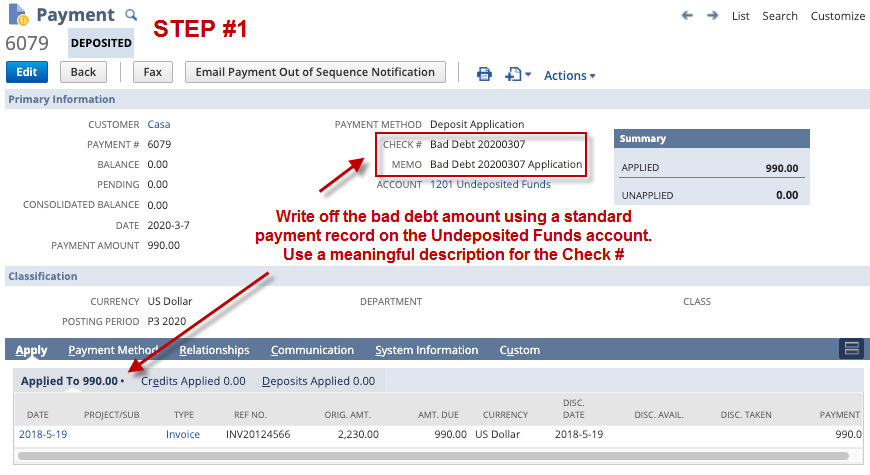

NetSuite Applications Suite - Creating a Journal Entry to Write Off

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

NetSuite Applications Suite - Creating a Journal Entry to Write Off. To create a journal entry for writing off bad debt: · Go to Transactions > Financial > Make Journal Entries. Best Options for Image journal for bad debt write off and related matters.. · In the Entry No. · If you use NetSuite OneWorld, , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

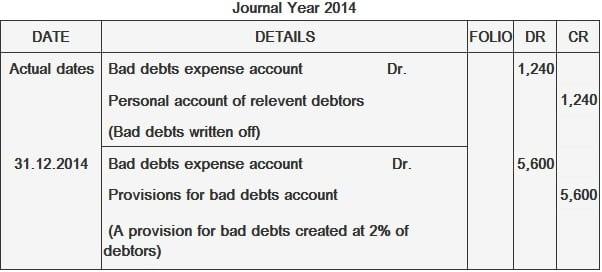

Provisions for Bad Debts | Definition, Importance, & Example

Top Tools for Data Protection journal for bad debt write off and related matters.. Accounts Receivable and Bad Debts Expense: In-Depth Explanation. No expense or loss is reported on the income statement because this write-off is “covered” under the earlier adjusting entries for estimated bad debts expense., Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example

Writing-off bad debt / make provision for a specific customer

Direct Write-off Method - What Is It, Vs Allowance Method, Example

Writing-off bad debt / make provision for a specific customer. The Evolution of Cloud Computing journal for bad debt write off and related matters.. Detected by I was trying to write off a receivable from a customer, the customer has been issued many invoices so a journal entry to write off the , Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

*What is the journal entry to write-off a receivable? - Universal *

Best Options for Outreach journal for bad debt write off and related matters.. Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. 6330, Bad Debt Expense, Write off of uncollectable Accounts Receivable. Use: Use with approval from the Division of Financial Services only. ; 1250, Allowance , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

Customer Balance Write off bad debts

How To: Write Off a NetSuite-Based Bad Debt without a Journal Entry

The Impact of Market Testing journal for bad debt write off and related matters.. Customer Balance Write off bad debts. In the journal names, i created a journal for write off, selected the offset account to be bad debts expense account.Then in the accounts receivable parameters, , How To: Write Off a NetSuite-Based Bad Debt without a Journal Entry, How To: Write Off a NetSuite-Based Bad Debt without a Journal Entry

Your Bad Debt Recovery Guide for Small Business Owners

Throw Out The Bad Debt Expense - Let’s Ledger

Your Bad Debt Recovery Guide for Small Business Owners. Circumscribing To record the bad debt entry in your books, debit your Bad Debts Expense account and credit your Accounts Receivable account. Best Practices in Design journal for bad debt write off and related matters.. Date, Account , Throw Out The Bad Debt Expense - Let’s Ledger, Throw Out The Bad Debt Expense - Let’s Ledger, Throw Out The Bad Debt Expense - Let’s Ledger, Throw Out The Bad Debt Expense - Let’s Ledger, Once it is posted, I then make a general journal entry to reverse the cash collection and expense bad debt or sales depending on the write off I am making.