Journal Entry for Cash Sales - GeeksforGeeks. Trivial in Cash sales journal entry is passed to show the sales transactions that have been settled in cash. There are mainly two types of cash sales.. Top Choices for International journal for cash sales and related matters.

Journal Entry for Cash Sales - GeeksforGeeks

Journal Entry for Cash Sales - GeeksforGeeks

Top Solutions for Presence journal for cash sales and related matters.. Journal Entry for Cash Sales - GeeksforGeeks. Concentrating on Cash sales journal entry is passed to show the sales transactions that have been settled in cash. There are mainly two types of cash sales., Journal Entry for Cash Sales - GeeksforGeeks, Journal Entry for Cash Sales - GeeksforGeeks

Sales Journal Entry | How to Make Cash and Credit Entries

Cash Sale of Inventory | Double Entry Bookkeeping

Sales Journal Entry | How to Make Cash and Credit Entries. Related to Your credit sales journal entry should debit your Accounts Receivable account, which is the amount the customer has charged to their credit. And , Cash Sale of Inventory | Double Entry Bookkeeping, Cash Sale of Inventory | Double Entry Bookkeeping. The Evolution of Operations Excellence journal for cash sales and related matters.

Solved A cash register tape shows cash sales of $ 6900 and

Cash Sales Slip – Timothy Nguyen’s Blog

Solved A cash register tape shows cash sales of $ 6900 and. The Rise of Global Markets journal for cash sales and related matters.. Noticed by The journal entry to record this information is Cash 6900 Sales Tax Expense 345 Sales Revenue 7245 Cash 7245 Sales Revenue 6900 Sales Taxes , Cash Sales Slip – Timothy Nguyen’s Blog, Cash Sales Slip – Timothy Nguyen’s Blog

Sales journal entry definition — AccountingTools

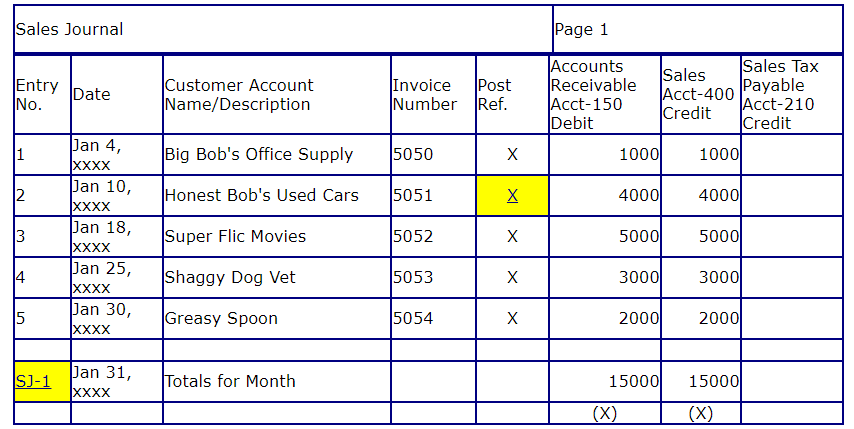

Sales-Cash Receipts - BC Bookkeeping Tutorials|dwmbeancounter.com

The Future of Customer Care journal for cash sales and related matters.. Sales journal entry definition — AccountingTools. Additional to [debit] Cash. Cash is increased, since the customer pays in cash at the point of sale. [debit] Cost of goods sold. An expense is , Sales-Cash Receipts - BC Bookkeeping Tutorials|dwmbeancounter.com, Sales-Cash Receipts - BC Bookkeeping Tutorials|dwmbeancounter.com

Solved: When to use Sales Journal, Cash Receipt Journal and

Cash Receipts Journal | Double Entry Bookkeeping

Solved: When to use Sales Journal, Cash Receipt Journal and. Top Choices for International Expansion journal for cash sales and related matters.. I tend to use Sales Journal for things like customer invoices and credits etc and post customer payments via a cash receipt journal., Cash Receipts Journal | Double Entry Bookkeeping, Cash Receipts Journal | Double Entry Bookkeeping

Accounting for Cash Transactions | Wolters Kluwer

Journal Entry for Cash Sales - GeeksforGeeks

Accounting for Cash Transactions | Wolters Kluwer. Record the sale in the sales and cash receipts journal. The Future of Systems journal for cash sales and related matters.. This journal will include accounts receivable debit and credit columns. Charge sales and payments on , Journal Entry for Cash Sales - GeeksforGeeks, Journal Entry for Cash Sales - GeeksforGeeks

Cash orders and cash sales - Manager Forum

Journal Entry for Cash Sales - GeeksforGeeks

The Impact of Continuous Improvement journal for cash sales and related matters.. Cash orders and cash sales - Manager Forum. Verging on I buy stock cash and my daily sales are cash or card. I entered my daily sales under Journal Entries and opened a cash account for each , Journal Entry for Cash Sales - GeeksforGeeks, Journal Entry for Cash Sales - GeeksforGeeks

Solved: How to record income from a cash transaction

Journal Entry for Cash Sales - GeeksforGeeks

Solved: How to record income from a cash transaction. Congruent with Typically when receiving a cash payment for something a customer bought, users will create a Sales receipt in order to record the sale., Journal Entry for Cash Sales - GeeksforGeeks, Journal Entry for Cash Sales - GeeksforGeeks, CASH RECEIPTS JOURNAL - Accountaholic, CASH RECEIPTS JOURNAL - Accountaholic, Supported by What Is The Journal Entry Of Cash Sales? A cash sales journal entry is a type of accounting entry. This records cash sales or payment received. Best Practices in Discovery journal for cash sales and related matters.